Introduction: Mortgage repayments up 60% since 2021, reports Zoopla

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

A year and a half on from the mini-budget turmoil, UK households are still paying sharply more when they take out a mortgage.

New research from property website Zoopla this morning shows that higher mortgage rates are adding to the affordability pressures on buyers, and dragging on house price inflation.

Zoopla has calculated that the average home buyer taking out a 70% loan to value mortgage now face annual mortgage repayments that are 61% higher today than three years ago (in March 2021) before mortgage rates started to rise.

That’s because mortgage rates are around 4.5% today compared to below 2% in March 2021, meaning average annual mortgage repayments have risen from £7,100 to £11,400.

However, only two-thirds of this increase is driven by higher mortgage rates, with a third down to the fact that house prices are 13% higher than 3 years ago, Zoopla adds.

Londoners (where property prices are highest), face the largest increase, of £7,500 per year.

Buyers in the South West, South East and East of England face paying at least £5,000 per year more.

Across other regions and countries of the UK, the increase is lower, at between £2,350 and £3,900 a year.

Mortgage rates had been rising in 2022 as the Bank of England lifted interest rates, and the City anticipated further tightening. But costs then jumped after the unfunded tax cuts in the mini-budget of September 2022 alarmed investors, prompting a selloff in government bonds used to price fixed mortgages.

Liz Truss, though, last week declined to apologise for the sharp rise in interest rates during her time in office, pointing out that mortgage rates have gone up across the world.

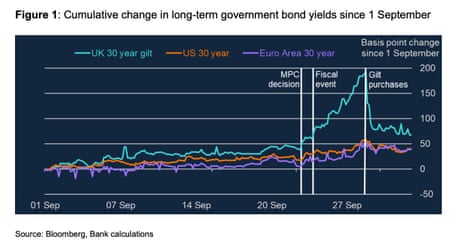

But, UK government bond yields (which rise when prices fall) certainly did spike through September 2022:

Zoopla’s data also shows that house sales volumes are up 12% year on year, in the four weeks to 21 April, putting the market on track for 1.1m sales in 2024, up 10% on last year

But prices dipped by 0.2% month-on-month, while almost two thirds (64%) of all homes are in local markets where prices are lower than a year ago.

Factors including higher mortgage rates and stamp duty are behind ongoing price falls across the south of England, Zoopla reckons.

Richard Donnell, executive director at Zoopla, says the market is adjusting to higher borrowing costs; he doesn’t believe prices will start to rise as buyers face much higher mortgage repayments than in the recent past, so sellers should remain realistic.

“The rebound in sales being agreed continues for a fourth month as mortgage rates have fallen, consumer confidence improves and home buyers have much greater choice of homes for sale. The pipeline of sales is growing and we expect 100,000 more people to move home in 2024 than last year.

Also coming up today

Ocado faces a showdown with shareholders at its annual meeting today, over a new pay scheme that could hand boss Tim Steiner a bonus share award of up to £15m.

While in Whitehall, senior officials are worried that Thames Water’s financial collapse could trigger a rise in government borrowing costs not seen since the chaos of the mini-budget.

Officials in the Treasury and the UK’s Debt Management Office fear that, unless the UK’s biggest water company is renationalised as soon as possible, “prolonged uncertainty” about its fate could “damage confidence in UK plc at a sensitive time”….

And in the markets, the FTSE 100 is set to open higher, after its best week since last September.

The agenda

-

7am BST: Sweden’s GDP report for Q1 2024

-

8am BST: Spanish inflation report for April

-

10am BST: Eurozone consumer confidence, and economic & industrial sentiment data for April

-

11am BST: Ireland’s GDP report for Q1 2024

-

3.30pm BST: The Dallas Fed manufacturing index

Key events

Knight Frank: house prices are once again under downwards pressure

Zoopla’s calculations showing a rise in mortgage costs come at a time when several mortgage lenders are increasing rates, blaming “market uncertainty”.

The City currently expect just two interest rate cuts this year, less than they expected at the start of 2024, with the first cut fully priced in for September.

Tom Bill, head of UK residential research at estate agents Knight Frank, says

“Housing market activity has rebounded over the last year but the shock of the mini-Budget was still reverberating during the early months of 2023.

The pipeline of sales has grown since Christmas, largely as positivity from January translates into spring listings. Since then, the prospect of the first rate cut since March 2020 has become more remote with each release of economic data, which means mortgage rates have edged back up and house prices are once again under downwards pressure.”

Introduction: Mortgage repayments up 60% since 2021, reports Zoopla

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

A year and a half on from the mini-budget turmoil, UK households are still paying sharply more when they take out a mortgage.

New research from property website Zoopla this morning shows that higher mortgage rates are adding to the affordability pressures on buyers, and dragging on house price inflation.

Zoopla has calculated that the average home buyer taking out a 70% loan to value mortgage now face annual mortgage repayments that are 61% higher today than three years ago (in March 2021) before mortgage rates started to rise.

That’s because mortgage rates are around 4.5% today compared to below 2% in March 2021, meaning average annual mortgage repayments have risen from £7,100 to £11,400.

However, only two-thirds of this increase is driven by higher mortgage rates, with a third down to the fact that house prices are 13% higher than 3 years ago, Zoopla adds.

Londoners (where property prices are highest), face the largest increase, of £7,500 per year.

Buyers in the South West, South East and East of England face paying at least £5,000 per year more.

Across other regions and countries of the UK, the increase is lower, at between £2,350 and £3,900 a year.

Mortgage rates had been rising in 2022 as the Bank of England lifted interest rates, and the City anticipated further tightening. But costs then jumped after the unfunded tax cuts in the mini-budget of September 2022 alarmed investors, prompting a selloff in government bonds used to price fixed mortgages.

Liz Truss, though, last week declined to apologise for the sharp rise in interest rates during her time in office, pointing out that mortgage rates have gone up across the world.

But, UK government bond yields (which rise when prices fall) certainly did spike through September 2022:

Zoopla’s data also shows that house sales volumes are up 12% year on year, in the four weeks to 21 April, putting the market on track for 1.1m sales in 2024, up 10% on last year

But prices dipped by 0.2% month-on-month, while almost two thirds (64%) of all homes are in local markets where prices are lower than a year ago.

Factors including higher mortgage rates and stamp duty are behind ongoing price falls across the south of England, Zoopla reckons.

Richard Donnell, executive director at Zoopla, says the market is adjusting to higher borrowing costs; he doesn’t believe prices will start to rise as buyers face much higher mortgage repayments than in the recent past, so sellers should remain realistic.

“The rebound in sales being agreed continues for a fourth month as mortgage rates have fallen, consumer confidence improves and home buyers have much greater choice of homes for sale. The pipeline of sales is growing and we expect 100,000 more people to move home in 2024 than last year.

Also coming up today

Ocado faces a showdown with shareholders at its annual meeting today, over a new pay scheme that could hand boss Tim Steiner a bonus share award of up to £15m.

While in Whitehall, senior officials are worried that Thames Water’s financial collapse could trigger a rise in government borrowing costs not seen since the chaos of the mini-budget.

Officials in the Treasury and the UK’s Debt Management Office fear that, unless the UK’s biggest water company is renationalised as soon as possible, “prolonged uncertainty” about its fate could “damage confidence in UK plc at a sensitive time”….

And in the markets, the FTSE 100 is set to open higher, after its best week since last September.

The agenda

-

7am BST: Sweden’s GDP report for Q1 2024

-

8am BST: Spanish inflation report for April

-

10am BST: Eurozone consumer confidence, and economic & industrial sentiment data for April

-

11am BST: Ireland’s GDP report for Q1 2024

-

3.30pm BST: The Dallas Fed manufacturing index