Introduction: UK house prices rise for third month running, close to record high

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

UK house prices have risen for the third straight month, lender Halifax reports this morning, helped by lower borrowing costs.

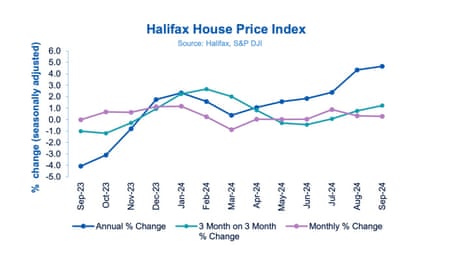

According to Halifax, the average house price rose by 0.3% in September to £293,399, up from £292,540 in August, which pushed the annual growth rate up to 4.7%.

This left the average price only a little short of the record high of £293,507 set in June 2022, on Halifax’s index, before the market started to slide in autumn 2022 after the mini-budget pushed up mortgage rates.

Amanda Bryden, Head of Mortgages at Halifax, says improved mortgage affordability is stimulating the market.

But, she adds, it’s “essential” to view these recent gains in context.

Bryden explains:

While the typical property value has risen by around £13,000 over the past year, this increase is largely a recovery of the ground lost over the previous 12 months. Looking back two years, prices have increased by just +0.4% (£1,202).

Market conditions have steadily improved over the summer and into early autumn. Mortgage affordability has been easing thanks to strong wage growth and falling interest rates. This has boosted confidence among potential buyers, with the number of mortgages agreed up over 40% in the last year and now at their highest level since July 2022.

While improved mortgage affordability should continue to support buyer activity – boosted by anticipated further cuts to interest rates – housing costs remain a challenge for many. As a result we expect property price growth over the rest of this year and into next to remain modest.”

The agenda

-

7am BST: Halifax house price index for September

-

7am BST: German factory orders for August

-

9.30am BST: Sentix survey of eurozone investor confidence

-

10am BST: Eurozone retail sales for August

Key events

On an annual basis, UK house price inflation was nearly a two-year high last month.

The 4.7% increase in house prices on an annual basis in September is the fastest annual rate since November 2022, according to data from Halifax.

Unsurprisingly, London continues to have the most expensive property prices in the UK.

Halifax reports that the average house price in the capital rose by 2.6% in the year to September, to £539,238.

That’s still below the capital’s peak property price of £552,592 set in August 2022.

Halifax’s data also shows that first time buyers are paying less for a home than in 2022.

Todays report explains:

The average amount paid by first-time buyers has increased by +4.2% over the past year, which equates to an extra £9,409 in cash terms. This brings the typical first-time buyer property price up to £232,769, its highest level since May 2024.

However that’s still about £1,000 less than the average amount paid by a first-time buyer two years ago (£233,760), a decrease of around -0.4%.

Northern Ireland continues to record the strongest annual house price growth in the UK

Halifax reports that Northern Ireland continues to record the strongest property price growth of any nation or region in the UK.

The average price of a property in Northern Ireland is now £203,593, after prices rose by. 9.7% on an annual basis in September.

House prices in Wales rose by 4.4% to an average of £224,119.

Scotland saw a more modest rise in house prices, up 2.1%, meaning a typical property now costs £205,718.

Across England, the North West recorded the strongest house price growth of any region in England, up by +5.1% over the last year, to sit at £234,355.

Introduction: UK house prices rise for third month running, close to record high

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

UK house prices have risen for the third straight month, lender Halifax reports this morning, helped by lower borrowing costs.

According to Halifax, the average house price rose by 0.3% in September to £293,399, up from £292,540 in August, which pushed the annual growth rate up to 4.7%.

This left the average price only a little short of the record high of £293,507 set in June 2022, on Halifax’s index, before the market started to slide in autumn 2022 after the mini-budget pushed up mortgage rates.

Amanda Bryden, Head of Mortgages at Halifax, says improved mortgage affordability is stimulating the market.

But, she adds, it’s “essential” to view these recent gains in context.

Bryden explains:

While the typical property value has risen by around £13,000 over the past year, this increase is largely a recovery of the ground lost over the previous 12 months. Looking back two years, prices have increased by just +0.4% (£1,202).

Market conditions have steadily improved over the summer and into early autumn. Mortgage affordability has been easing thanks to strong wage growth and falling interest rates. This has boosted confidence among potential buyers, with the number of mortgages agreed up over 40% in the last year and now at their highest level since July 2022.

While improved mortgage affordability should continue to support buyer activity – boosted by anticipated further cuts to interest rates – housing costs remain a challenge for many. As a result we expect property price growth over the rest of this year and into next to remain modest.”

The agenda

-

7am BST: Halifax house price index for September

-

7am BST: German factory orders for August

-

9.30am BST: Sentix survey of eurozone investor confidence

-

10am BST: Eurozone retail sales for August