The United Kingdom’s FTSE 100 index recently experienced a downturn, closing lower after weak trade data from China highlighted ongoing struggles in the global economy. Despite these challenges, certain high-growth tech stocks in the UK continue to show promise, driven by innovation and resilience amidst broader market uncertainties.

Top 10 High Growth Tech Companies In The United Kingdom

|

Name |

Revenue Growth |

Earnings Growth |

Growth Rating |

|---|---|---|---|

|

Filtronic |

21.64% |

33.46% |

★★★★★★ |

|

YouGov |

14.30% |

29.79% |

★★★★★☆ |

|

Facilities by ADF |

32.33% |

94.46% |

★★★★★★ |

|

STV Group |

13.43% |

47.09% |

★★★★★☆ |

|

Redcentric |

4.89% |

63.79% |

★★★★★☆ |

|

Trustpilot Group |

16.23% |

31.98% |

★★★★★☆ |

|

IQGeo Group |

11.49% |

63.61% |

★★★★★☆ |

|

Vinanz |

113.60% |

125.86% |

★★★★★☆ |

|

Beeks Financial Cloud Group |

24.63% |

57.95% |

★★★★★☆ |

|

Seeing Machines |

24.07% |

93.93% |

★★★★★☆ |

Click here to see the full list of 48 stocks from our UK High Growth Tech and AI Stocks screener.

We’re going to check out a few of the best picks from our screener tool.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nexxen International Ltd. offers a comprehensive software platform for advertisers to connect with publishers in Israel, with a market cap of £414.56 million.

Operations: Nexxen International Ltd. generates revenue primarily from its marketing services, amounting to $339.02 million. The company operates an end-to-end software platform facilitating advertiser-publisher connections in Israel.

Nexxen International’s recent earnings report highlights a notable turnaround, with Q2 sales at $88.58 million, up from $84.25 million last year, and net income reaching $2.92 million compared to a prior net loss of $5.61 million. The company’s strategic data partnership with The Trade Desk enhances cross-channel targeting capabilities using Nexxen’s exclusive ACR data segments, which is crucial for addressing CTV advertising challenges. R&D expenses have shown consistent investment in innovation, supporting an 8.8% annual revenue growth forecast and expected earnings surge of 71.87% per year.

Simply Wall St Growth Rating: ★★★★☆☆

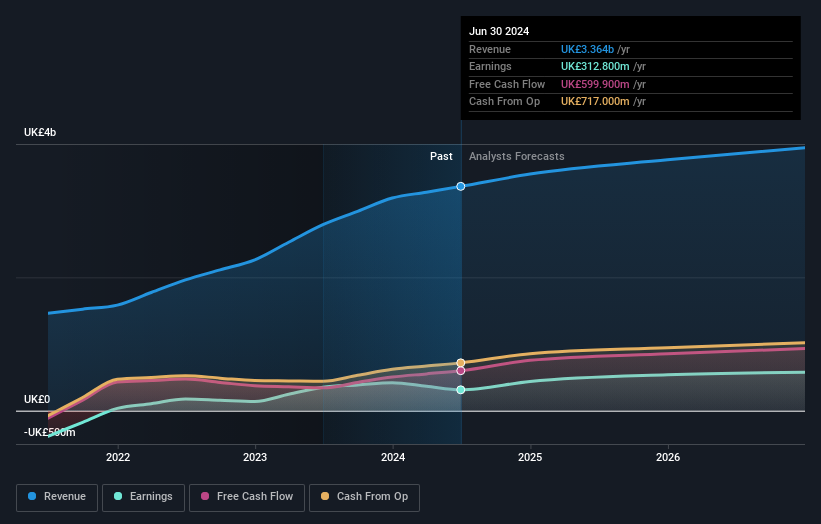

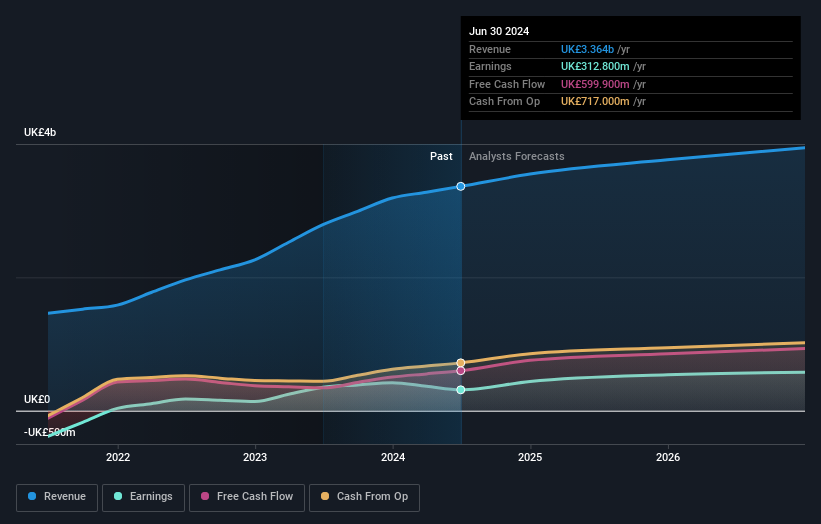

Overview: Informa plc operates as an international events, digital services, and academic research company in the United Kingdom, Continental Europe, the United States, China, and internationally with a market cap of £10.94 billion.

Operations: Informa generates revenue primarily through its Informa Markets (£1.67 billion), Informa Connect (£630.20 million), Taylor & Francis (£636.70 million), and Informa Tech (£426.70 million) segments, focusing on international events, digital services, and academic research across various regions including the UK, Europe, the US, and China.

Informa’s earnings are forecast to grow at 21.5% annually, significantly outpacing the UK market’s 14.3%. Despite a large one-off loss of £213.5 million impacting recent financial results, the company reported half-year sales of £1.70 billion, up from £1.52 billion last year, with net income at £147.3 million compared to £253.5 million previously. The company repurchased 41,673,066 shares in H1 2024 for £338.9 million and completed a total buyback of 191,882,685 shares since March 2022. Informa’s R&D expenses focus on enhancing digital capabilities and content delivery platforms to maintain competitive advantage in the media industry; this strategic investment is crucial given its revenue growth forecast of 6.7% per year against the UK market’s average of 3.7%. With new board appointments like Maria Kyriacou bringing extensive global entertainment experience from Paramount Global and ITV Studios, Informa aims to leverage leadership expertise for future growth opportunities in international markets and digital transformation initiatives.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Trustpilot Group plc develops and hosts an online review platform for businesses and consumers across the UK, North America, Europe, and internationally, with a market cap of £838.73 million.

Operations: Trustpilot Group plc generates revenue primarily from its Internet Information Providers segment, amounting to $176.36 million. The company focuses on developing and hosting an online review platform for businesses and consumers across various regions including the UK, North America, and Europe.

Trustpilot Group, a prominent player in the UK’s tech landscape, is forecast to see its revenue grow at 16.2% annually, outpacing the broader UK market’s 3.7%. The company’s earnings are projected to surge by 32% per year over the next three years. Trustpilot has recently become profitable and boasts a high-quality earnings profile. Significant R&D investments have been made to enhance its platform capabilities, with expenses reaching £12 million last year. The recent accelerated bookbuild process by Trafalgar Acquisition SARL could impact share liquidity and investor sentiment in the short term.

Where To Now?

-

Reveal the 48 hidden gems among our UK High Growth Tech and AI Stocks screener with a single click here.

-

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St’s portfolio, where intuitive tools await to help optimize your investment outcomes.

-

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:NEXN LSE:INF and LSE:TRST.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com