Getty Images

Getty ImagesThe Bank of England could cut interest rates more quickly if price rises remain under control, its governor has suggested.

Andrew Bailey told the Guardian that the Bank could be a “bit more aggressive” at cutting borrowing costs, depending on the rate of inflation.

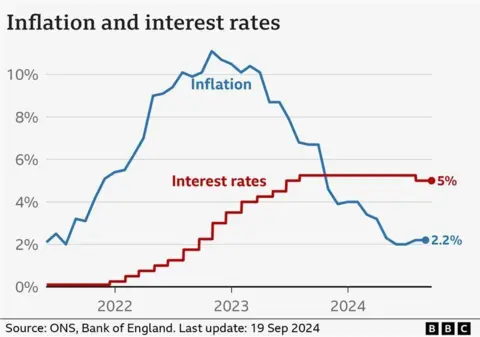

The Bank cut interest rates from 5.25% to 5% in August, which was the first drop in more than four years.

Mr Bailey also said that the Bank was watching developments in the Middle East “extremely closely”, in particular any movement in oil prices that could fuel inflation.

The Bank of England has two more more meetings left this year to decide on interest rates, in November and December.

At the Bank’s last gathering in September, Mr Bailey was optimistic that borrowing costs would continue to fall. But he said at the time it was “vital” inflation remained low.

The Bank raised interest rates steadily from the end of 2021 as inflation – the rate at which prices rise – surged, partly due to the increase in energy prices following Russia’s invasion of Ukraine.

However, now that inflation is currently close to the Bank’s 2% target, attention has focused on how many rate cuts will be made.

Falling interest rates will cut mortgage payments for households who have deals that track the Bank of England rate. However, the majority of mortgage customers have fixed-rate deals, so will not be affected immediately.

For savers, a cut in rates is likely to reduce the amount they earn on their money.

Many analysts expect the Bank to reduce rates at its meeting in November. However, following Mr Bailey’s interview with the Guardian, expectations increased of a rate cut in December as well.

The pound fell by nearly 1% against the dollar to $1.317 on Thursday morning, with expectations of lower rates meaning people think they will make less money on their cash in UK assets.

Oil prices

One factor that could affect inflation is any impact on energy prices following an escalation in the conflict between Israel and the Iran-backed armed group Hezbollah in Lebanon.

“Geopolitical concerns are very serious. It is tragic what’s going on,” Mr Bailey told the Guardian.

“There are obviously stresses and the real issue then is how they might interact with some still quite stretched markets in places.”

The oil price has risen above $76 a barrel this week over fears that supplies could be disrupted.

However, the oil price is still lower than levels seen earlier this year, and well below the peak of more than $130 a barrel seen in the aftermath of Russia’s invasion of Ukraine in 2022.

“My sense from all the conversations I have with counterparts in the region is that there is, for the moment, a strong commitment to keep the market stable,” Mr Bailey said.

Mr Bailey was asked about claims from former Prime Minister Liz Truss, who alleged that her mini-budget in 2022 was not implemented because the Bank of England – among other members of the so-called “deep state” – had undermined her.

“I don’t know what she means by that,” Mr Bailey told the Guardian. He added that he had never met Truss, who was Britain’s prime minister for 49 days.

Mortgage rates soared in the wake of the mini-budget following turmoil on the financial markets.

The Bank of England will announce its next interest rate decision on 7 November.

Ways to make your mortgage more affordable

- Make overpayments. If you still have some time on a low fixed-rate deal, you might be able to pay more now to save later.

- Move to an interest-only mortgage. It can keep your monthly payments affordable although you won’t be paying off the debt accrued when purchasing your house.

- Extend the life of your mortgage. The typical mortgage term is 25 years, but 30 and even 40-year terms are now available.