The current market sentiment in the United Kingdom has been impacted by weak trade data from China, causing the FTSE 100 to close lower amid concerns over global economic recovery. In this environment, identifying high-growth tech stocks can offer promising returns as they often demonstrate resilience and innovation-driven growth despite broader market challenges.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Altitude Group | 23.46% | 27.56% | ★★★★★☆ |

| YouGov | 14.29% | 29.79% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| LungLife AI | 100.61% | 100.97% | ★★★★★☆ |

| IQGeo Group | 11.49% | 63.61% | ★★★★★☆ |

| Beeks Financial Cloud Group | 24.63% | 57.95% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

| Spirent Communications | 5.51% | 40.77% | ★★★★☆☆ |

Click here to see the full list of 46 stocks from our UK High Growth Tech and AI Stocks screener.

Here’s a peek at a few of the choices from the screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Genus plc is an animal genetics company with operations spanning North America, Latin America, the United Kingdom, Europe, the Middle East, Russia, Africa, and Asia and has a market cap of approximately £1.26 billion.

Operations: The company generates revenue primarily from its two main segments: Genus ABS, which contributes £314.90 million, and Genus PIC, which contributes £352.50 million. The Central segment adds £1.40 million to the total revenue.

Genus, a leader in animal genetics, is navigating a challenging year with net income dropping to £7.9M from £33.3M last year. Despite this, earnings are forecasted to grow significantly at 39.4% annually over the next three years, outpacing the UK market’s 14.3%. The company continues investing heavily in R&D with expenses reaching £47.8M in the last fiscal year, underscoring its commitment to innovation despite facing one-off losses impacting financial results.

In addition to robust R&D efforts, Genus has proposed a final dividend of 21.7 pence per share for shareholders on record as of November 8th, payable on December 6th—a move likely aimed at retaining investor confidence amidst fluctuating profit margins now at 1.2%, down from last year’s 4.8%. With revenue expected to grow modestly by 4.1% annually and significant earnings growth projected, Genus remains focused on long-term strategic advancements within its sector.

Simply Wall St Growth Rating: ★★★★☆☆

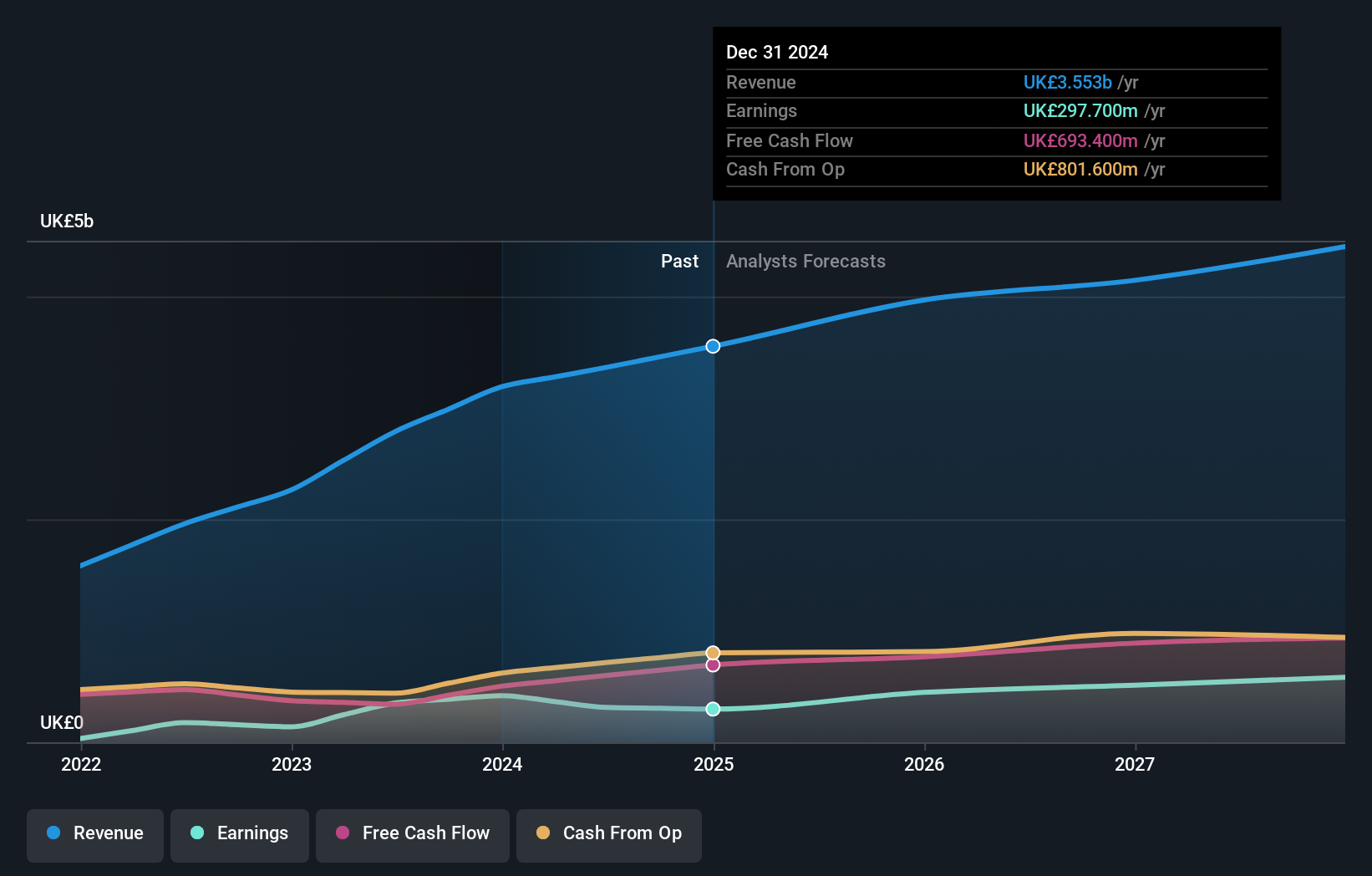

Overview: Informa plc operates as an international events, digital services, and academic research company in the United Kingdom, Continental Europe, the United States, China, and internationally with a market cap of £11.17 billion.

Operations: The company generates revenue from four primary segments: Informa Tech (£426.70 million), Informa Connect (£630.20 million), Informa Markets (£1.67 billion), and Taylor & Francis (£636.70 million).

Informa’s earnings are projected to grow at an impressive 21.5% annually, outpacing the UK market’s 14.3%. The company’s revenue is also expected to increase by 6.7% per year, surpassing the broader market growth of 3.7%. Recent R&D expenses highlight a commitment to innovation, with £47.8M invested last fiscal year, driving future advancements in its digital businesses segment. Additionally, Informa has repurchased 41.67M shares for £338.9M this year, reflecting strong shareholder value initiatives amidst evolving industry dynamics and executive changes.

Simply Wall St Growth Rating: ★★★★☆☆

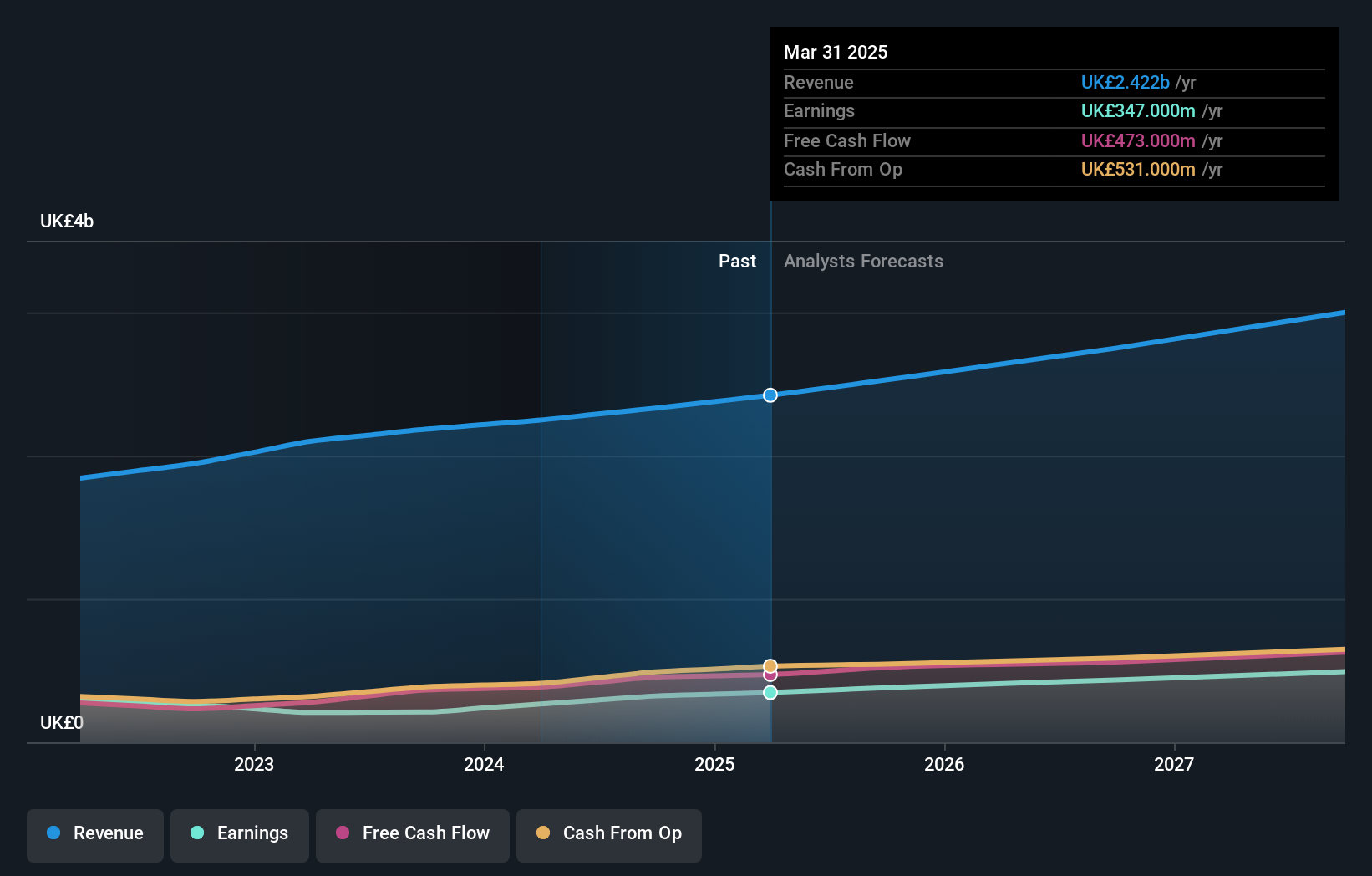

Overview: The Sage Group plc, together with its subsidiaries, provides technology solutions and services for small and medium businesses in the United States, the United Kingdom, France, and internationally, with a market cap of £10.36 billion.

Operations: Sage Group generates revenue primarily from technology solutions and services for small and medium businesses, with significant contributions from North America (£1.01 billion), Europe (£595 million), and the United Kingdom & Ireland (£488 million). The company has a market cap of £10.36 billion.

Sage Group’s recent collaboration with VoPay to embed advanced payment technology into its Business Cloud Payroll platform highlights its commitment to innovation and efficiency. This partnership addresses major pain points for SMBs by automating direct deposits and enhancing payroll functionalities, potentially driving significant growth in this segment. With a forecasted earnings growth of 15.1% annually, Sage’s strategic focus on SaaS models ensures recurring revenue streams. Notably, R&D expenses reached £47 million last fiscal year, underscoring their dedication to continuous improvement and technological advancement.

Key Takeaways

Ready For A Different Approach?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com