Over the last 7 days, the UK market has risen 1.2%, driven by gains of 10% in the Materials sector, while the Energy sector has shrunk 5.3%. With an overall market increase of 8.7% over the past year and earnings forecasted to grow by 14% annually, identifying high growth tech stocks can be crucial for capitalizing on these positive trends.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| YouGov | 14.29% | 29.79% | ★★★★★☆ |

| Facilities by ADF | 52.00% | 144.70% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Windar Photonics | 63.60% | 126.92% | ★★★★★☆ |

| LungLife AI | 100.61% | 100.97% | ★★★★★☆ |

| Beeks Financial Cloud Group | 24.63% | 57.95% | ★★★★★☆ |

| Oxford Biomedica | 20.98% | 106.13% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

Click here to see the full list of 47 stocks from our UK High Growth Tech and AI Stocks screener.

We’ll examine a selection from our screener results.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Genus plc is an animal genetics company with operations across North America, Latin America, the United Kingdom, Europe, the Middle East, Russia, Africa, and Asia and has a market cap of £1.32 billion.

Operations: Genus plc generates revenue primarily from its Genus ABS and Genus PIC segments, contributing £314.90 million and £352.50 million respectively, with a smaller contribution of £1.40 million from Central operations.

Despite a challenging year with net income dropping to £7.9 million from £33.3 million, Genus plc’s commitment to innovation remains evident in its R&D spending, crucial for staying competitive in biotech. With earnings forecasted to surge by 39.4% annually, the firm is poised for recovery, underpinned by a revenue growth rate of 4.1%, outpacing the UK market’s 3.7%. This resilience and strategic focus on development may well cushion against past volatility marked by significant one-off losses of £47.4 million last year, setting a cautiously optimistic future trajectory in high-tech biotechnology sectors.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Informa plc operates as an international events, digital services, and academic research company in the United Kingdom, Continental Europe, the United States, China, and internationally with a market cap of £11.09 billion.

Operations: Informa’s revenue streams include Informa Tech (£426.70 million), Informa Connect (£630.20 million), Informa Markets (£1.67 billion), and Taylor & Francis (£636.70 million). The company focuses on events, digital services, and academic research across multiple regions including the UK, Europe, the US, and China.

Amidst a landscape of evolving partnerships and strategic acquisitions, Informa’s commitment to expanding its influence in luxury and lifestyle markets is evident. With a recent announcement to acquire Ascential plc, enhancing its festival offerings, Informa is poised to leverage synergies across high-profile events like the Cannes Lions. This strategy complements a robust R&D focus where expenses have notably contributed to fostering innovation within the tech sector. Despite facing challenges with a significant one-off loss impacting earnings by £213.5 million last year, Informa’s revenue growth forecast at 6.8% annually outstrips the UK market prediction of 3.7%. Moreover, the company has demonstrated confidence through an aggressive share repurchase program totaling £1.3 billion since March 2022, underscoring its commitment to shareholder value amidst fluctuating financial metrics.

Simply Wall St Growth Rating: ★★★★☆☆

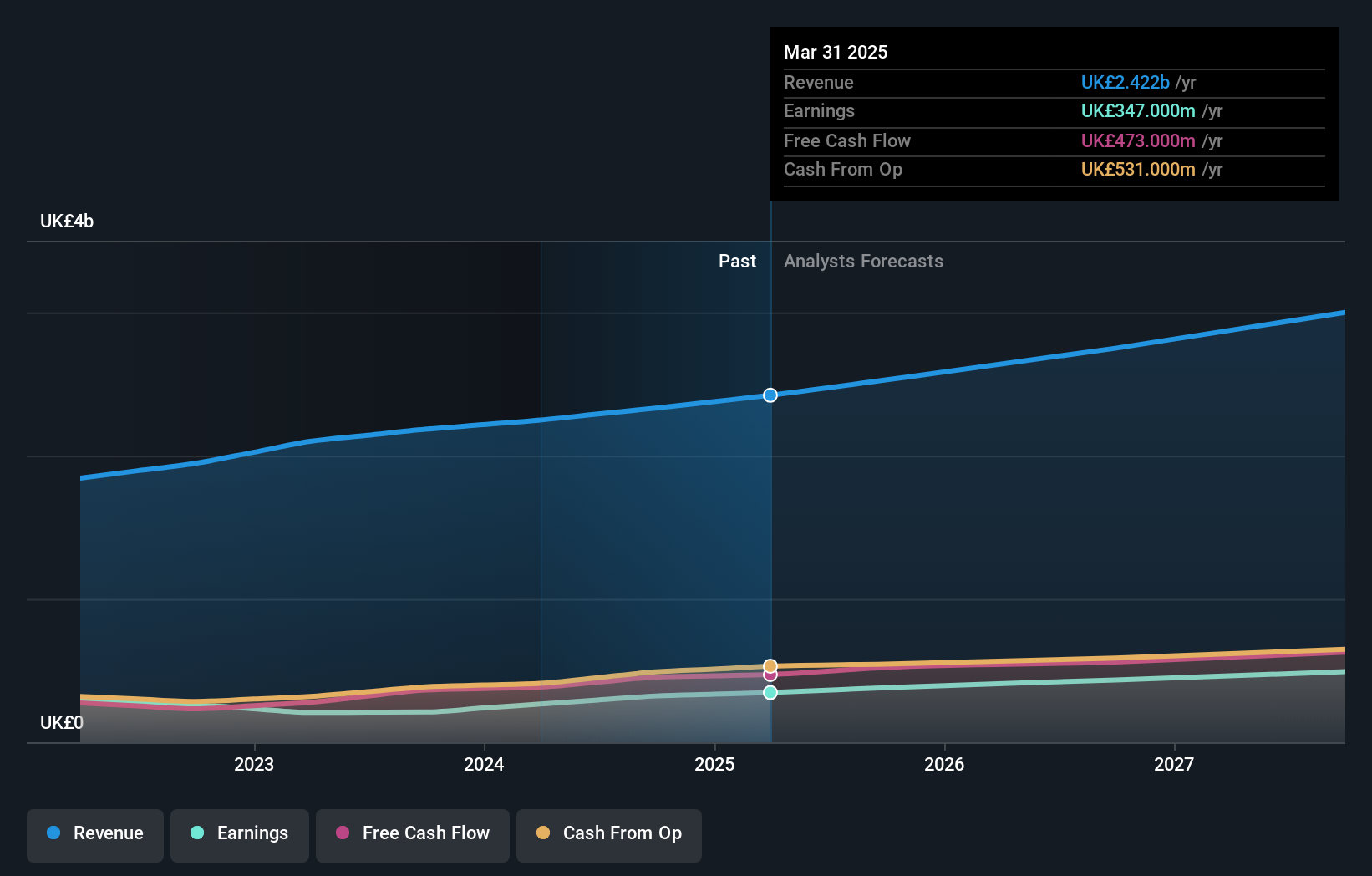

Overview: The Sage Group plc, along with its subsidiaries, offers technology solutions and services tailored for small and medium-sized businesses across the United States, the United Kingdom, France, and other international markets; it has a market cap of £10.34 billion.

Operations: Sage Group generates revenue primarily from technology solutions and services for small and medium businesses, with significant contributions from North America (£1.01 billion), Europe (£595 million), and the United Kingdom & Ireland (£488 million).

Sage Group, a prominent player in the software industry, is navigating the competitive landscape with strategic initiatives and robust financial performance. In 2024, the company reported a 9% increase in Q3 revenue to £585 million, emphasizing growth across its Sage Business Cloud portfolio. Notably, Sage’s R&D expenditure has been pivotal in enhancing product offerings and maintaining technological leadership; this investment aligns with their continuous revenue growth of 7.7% per year, outpacing the UK market average of 3.7%. Additionally, earnings are expected to surge by 15.1% annually, reflecting effective cost management and innovative product development. The recent partnership with VoPay introduces advanced payment technologies into Sage’s services, promising efficiency gains for SMBs through features like automated direct deposits and enhanced security measures—further testament to Sage’s commitment to integrating cutting-edge solutions that address client needs and drive business growth.

Turning Ideas Into Actions

- Click this link to deep-dive into the 47 companies within our UK High Growth Tech and AI Stocks screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com