Over the last 7 days, the United Kingdom market has dropped 1.3%, but it is up 8.3% over the past year, with earnings expected to grow by 14% per annum over the next few years. In this context, identifying high growth tech stocks involves looking for companies that not only show strong potential for revenue expansion but also align well with these optimistic earnings projections.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Altitude Group | 23.46% | 27.56% | ★★★★★☆ |

| YouGov | 14.29% | 29.79% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Trustpilot Group | 16.23% | 31.98% | ★★★★★☆ |

| LungLife AI | 100.61% | 100.97% | ★★★★★☆ |

| IQGeo Group | 11.49% | 63.61% | ★★★★★☆ |

| Beeks Financial Cloud Group | 24.63% | 57.95% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

| Spirent Communications | 5.51% | 40.77% | ★★★★☆☆ |

Click here to see the full list of 46 stocks from our UK High Growth Tech and AI Stocks screener.

Let’s dive into some prime choices out of from the screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Craneware plc, with a market cap of £828.40 million, develops, licenses, and supports computer software for the healthcare industry in the United States.

Operations: Craneware plc generates revenue primarily from its healthcare software segment, which brought in $189.27 million. The company focuses on developing, licensing, and supporting computer software tailored for the U.S. healthcare industry.

Craneware’s earnings for the year ended June 30, 2024, showed a robust increase with net income rising to $11.7 million from $9.23 million last year and basic earnings per share up to $0.335 from $0.263. This growth is further supported by their strategic collaboration with Microsoft, enhancing their Trisus Platform through Azure’s advanced tools and AI capabilities, which could significantly bolster operational efficiencies in healthcare services. Additionally, Craneware’s R&D expenditures reflect a commitment to innovation; they are actively seeking acquisitions that align with their growth strategy.

The company’s revenue grew by 8.2% annually while its earnings are expected to grow at an impressive rate of 25.6% per year over the next three years, outpacing the UK market’s forecasted growth of 14.4%. Their recent agreements with Microsoft not only expand cloud capabilities but also offer predictable spending and enhanced financial planning through the MACC agreement, driving cost efficiency and potentially increasing market reach via joint marketing initiatives in the healthcare sector.

Simply Wall St Growth Rating: ★★★★☆☆

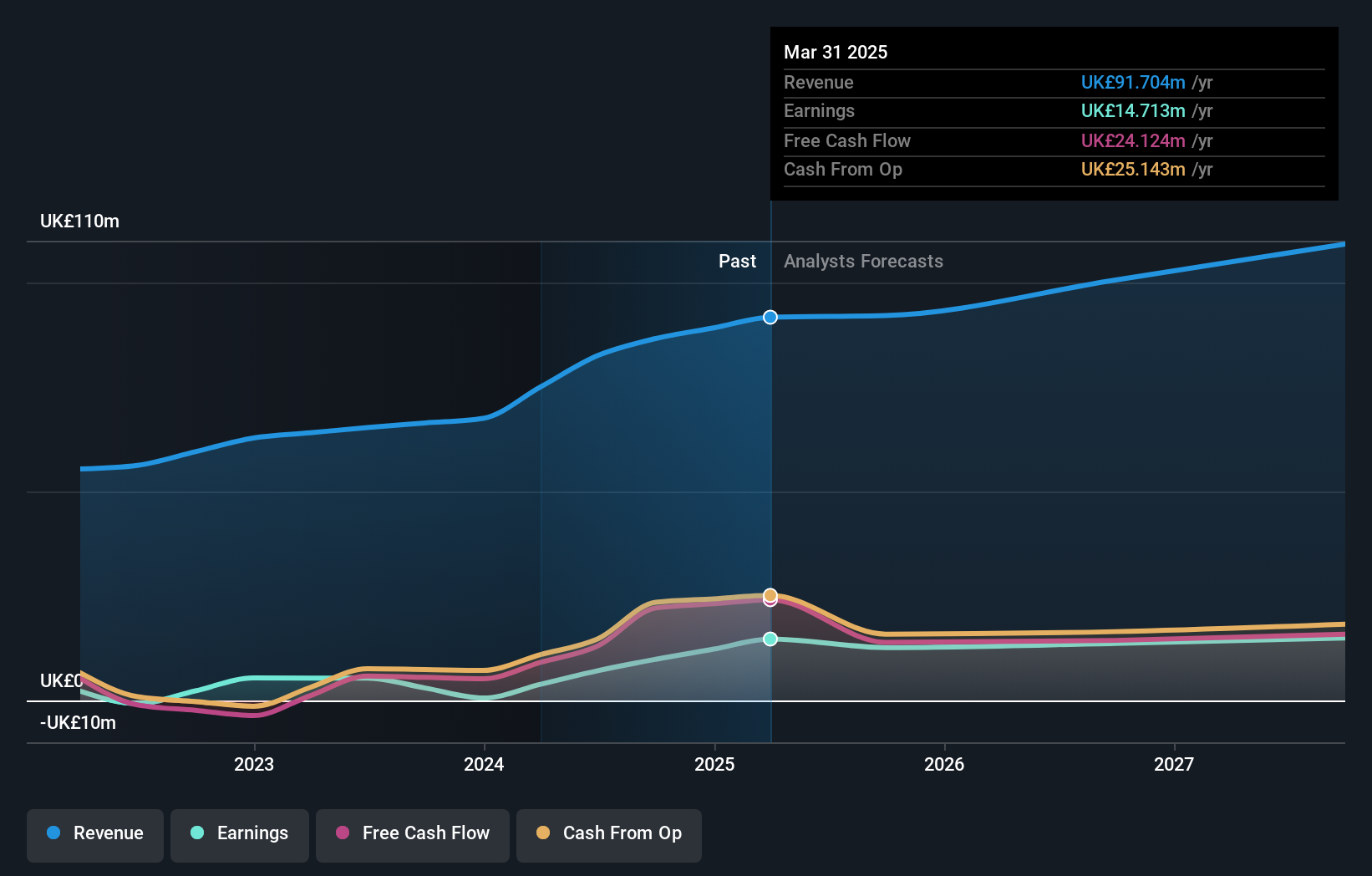

Overview: LBG Media plc operates as an online media publisher in the United Kingdom, Ireland, Australia, the United States, and internationally with a market cap of £281.21 million.

Operations: LBG Media plc generates revenue primarily from its online media publishing activities, amounting to £67.51 million. The company’s operations span the United Kingdom, Ireland, Australia, the United States, and other international markets.

LBG Media’s revenue is forecast to grow at 11.7% annually, outpacing the UK market’s 3.7%. Despite a significant one-off loss of £4.2M impacting last year’s financial results, earnings are projected to rise by an impressive 43.8% per year over the next three years. Their profit margins have seen a sharp drop from 8.6% last year to 0.9%, yet the company’s focus on innovative digital content and expanding reach could drive future growth opportunities in media and entertainment sectors.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Informa plc operates as an international events, digital services, and academic research company in the United Kingdom, Continental Europe, the United States, China, and internationally with a market cap of £11.11 billion.

Operations: Informa generates revenue through four primary segments: Informa Tech (£426.70 million), Informa Connect (£630.20 million), Informa Markets (£1.67 billion), and Taylor & Francis (£636.70 million). The company focuses on international events, digital services, and academic research across various regions including the UK, Europe, the US, and China.

Informa’s revenue is forecast to grow at 6.7% annually, outpacing the UK market’s 3.7%. Despite a significant one-off loss of £213.5M impacting last year’s financial results, earnings are projected to rise by an impressive 21.5% per year over the next three years. The company repurchased 41,673,066 shares for £338.9M in the first half of 2024 and completed a total buyback of 191,882,685 shares worth £1.30B since March 2022.

Next Steps

Curious About Other Options?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com