The London markets have been under pressure recently, with the FTSE 100 closing lower due to weak trade data from China and a general decline in global cues. Despite these challenges, high-growth tech stocks in the UK present intriguing opportunities for investors seeking resilience and innovation amidst broader market volatility.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Altitude Group | 23.46% | 27.56% | ★★★★★☆ |

| Filtronic | 21.64% | 33.46% | ★★★★★★ |

| YouGov | 14.43% | 29.79% | ★★★★★☆ |

| STV Group | 13.43% | 47.09% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| LungLife AI | 100.61% | 100.97% | ★★★★★☆ |

| Trustpilot Group | 16.23% | 31.98% | ★★★★★☆ |

| IQGeo Group | 11.49% | 63.61% | ★★★★★☆ |

| Beeks Financial Cloud Group | 24.63% | 57.95% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

Click here to see the full list of 46 stocks from our UK High Growth Tech and AI Stocks screener.

Let’s review some notable picks from our screened stocks.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GB Group plc, along with its subsidiaries, offers identity data intelligence products and services across the United Kingdom, the United States, Australia, and internationally with a market cap of £866.26 million.

Operations: GB Group plc generates revenue primarily through three segments: Identity (£156.06 million), Location (£81.07 million), and Fraud (£40.20 million).

GB Group’s revenue is projected to grow 6.8% annually, outpacing the UK market’s 3.7%. Despite a net loss of £48.58 million for FY24, the company is expected to turn profitable within three years, with earnings forecasted to surge by 92.89% per year. The firm recently declared a final dividend of 4.20 pence per share, totaling £10.6 million for FY24, reflecting its commitment to shareholder returns amidst operational efficiency gains from R&D investments.

Simply Wall St Growth Rating: ★★★★☆☆

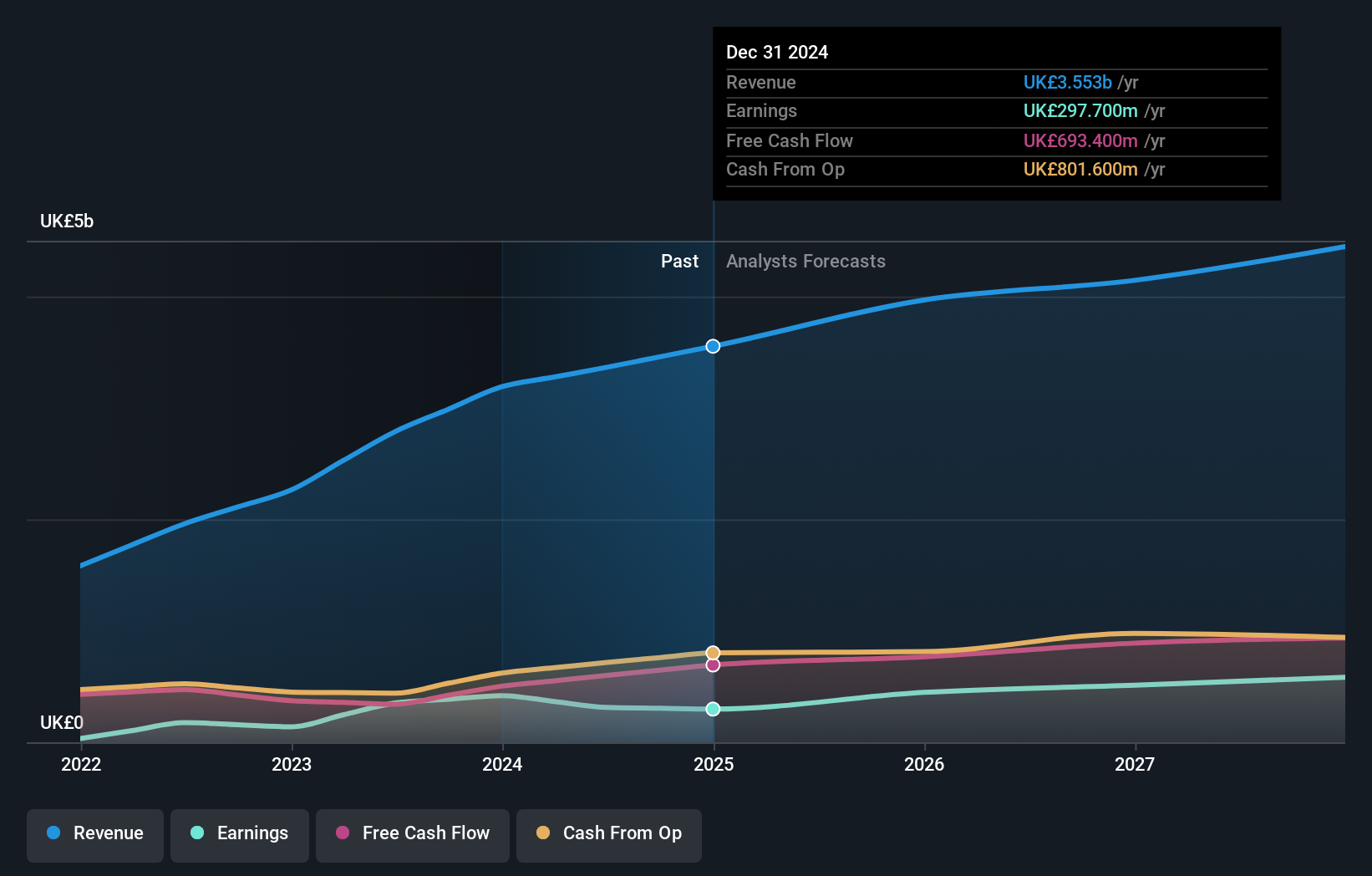

Overview: Informa plc is an international company specializing in events, digital services, and academic research with operations in the United Kingdom, Continental Europe, the United States, China, and other global markets; it has a market cap of £11.02 billion.

Operations: Informa generates revenue through four primary segments: Informa Tech (£426.70 million), Informa Connect (£630.20 million), Informa Markets (£1.67 billion), and Taylor & Francis (£636.70 million). The company operates internationally, including key markets in the UK, Europe, the US, and China.

Informa’s revenue is projected to grow 6.7% annually, surpassing the UK market’s 3.7%, while earnings are expected to increase by 21.5% per year, outpacing the market average of 14.3%. The company recently repurchased 41.67 million shares for £338.9 million, reflecting a robust commitment to shareholder returns amidst strategic buybacks totaling £1.30 billion since March 2022. Despite a one-off loss of £213.5 million impacting recent financials, Informa’s R&D investments have been pivotal in driving innovation and operational efficiency within its diverse business segments.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Trustpilot Group plc operates an online review platform for businesses and consumers across the United Kingdom, North America, Europe, and internationally, with a market cap of £896.24 million.

Operations: Trustpilot Group plc generates revenue primarily from its Internet Information Providers segment, amounting to $176.36 million. The company focuses on developing and hosting an online review platform catering to various regions including the United Kingdom, North America, and Europe.

Trustpilot Group’s revenue is projected to grow at 16.2% annually, outpacing the UK market’s average of 3.7%, while earnings are forecasted to increase by an impressive 32% per year. The company’s recent profitability marks a significant milestone, with R&D expenses playing a crucial role in this transformation; last year’s R&D expenditure was £15 million, driving innovation and enhancing platform capabilities. This focus on research and development underscores Trustpilot’s commitment to maintaining its competitive edge in the interactive media sector.

Summing It All Up

- Take a closer look at our UK High Growth Tech and AI Stocks list of 46 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St’s portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St’s app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com