The United Kingdom market has been flat over the last week but is up 7.5% over the past year, with earnings expected to grow by 14% per annum in the coming years. In this context of steady growth, identifying high-growth tech stocks involves looking for companies that demonstrate strong innovation capabilities and robust financial health, positioning them well to capitalize on future opportunities.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| YouGov | 14.29% | 29.79% | ★★★★★☆ |

| Facilities by ADF | 52.00% | 144.70% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Windar Photonics | 63.60% | 126.92% | ★★★★★☆ |

| LungLife AI | 100.61% | 100.97% | ★★★★★☆ |

| Oxford Biomedica | 21.00% | 98.44% | ★★★★★☆ |

| Beeks Financial Cloud Group | 22.12% | 36.94% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

Click here to see the full list of 47 stocks from our UK High Growth Tech and AI Stocks screener.

Here’s a peek at a few of the choices from the screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Capita plc offers consulting, digital, and software products and services to both private and public sector clients in the UK and internationally, with a market cap of £354.11 million.

Operations: Capita generates revenue primarily from two segments: Capita Experience (£1.12 billion) and Capita Public Service (£1.49 billion). The company’s operations encompass consulting, digital, and software solutions for diverse clients across the UK and international markets.

Capita, amid strategic shifts and leadership changes, shows signs of pivotal transformation with the recent appointment of Jack Clarke as Independent Non-Executive Director, enhancing governance as it navigates recovery. The company’s commitment to innovation is underscored by a significant contract extension worth up to £135 million to manage the UK’s smart meter communications, reinforcing its role in national infrastructure projects. Despite a modest revenue growth forecast at 1.5% annually, Capita’s earnings are expected to surge by an impressive 52.1% yearly, signaling potential recovery and profitability ahead. This juxtaposition of slow revenue growth with aggressive profit projections suggests a focus on operational efficiency and perhaps cost management strategies that could reshape its financial contours in the coming years.

Simply Wall St Growth Rating: ★★★★☆☆

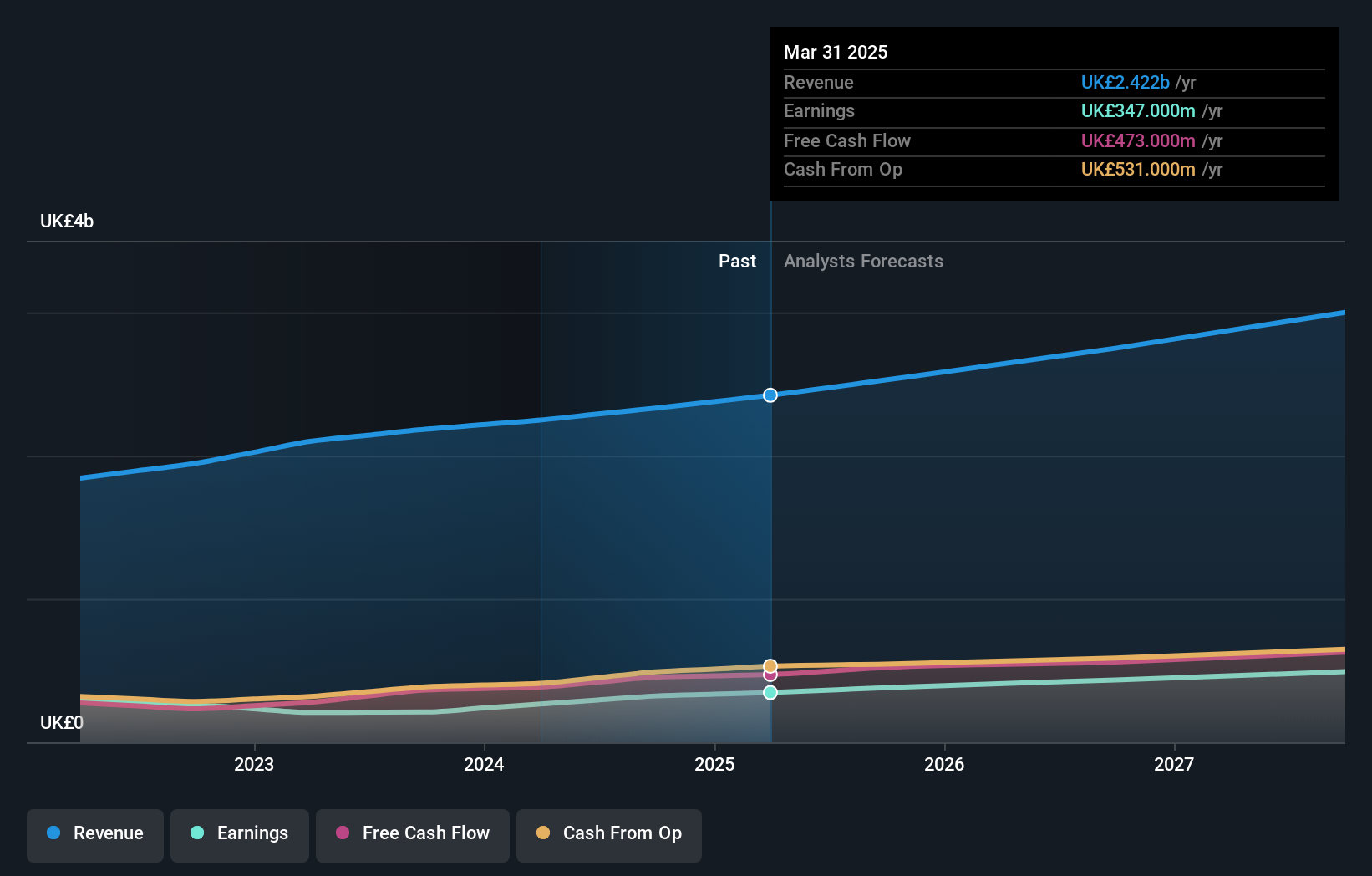

Overview: Informa plc is an international company engaged in events, digital services, and academic research across the UK, Continental Europe, the US, China, and other global markets with a market cap of £10.83 billion.

Operations: Informa generates revenue through four main segments: Informa Tech (£426.70 million), Informa Connect (£630.20 million), Informa Markets (£1.67 billion), and Taylor & Francis (£636.70 million). The company’s diverse operations span events, digital services, and academic research across multiple regions including the UK, Europe, the US, and China.

Informa, a UK-based high-growth tech entity, has shown resilience with a 6.9% annual revenue growth rate, outpacing the broader UK market’s average of 3.5%. This growth is complemented by an impressive projected earnings increase of 22.5% per year, signaling robust future profitability. The company recently enhanced its strategic position through acquisitions like Ascential plc and expanded partnerships such as with the Principality of Monaco, strengthening its foothold in luxury and lifestyle markets globally. Moreover, Informa’s commitment to innovation is evident from its R&D spending trends which are crucial for maintaining competitive advantage in the dynamic tech landscape.

Simply Wall St Growth Rating: ★★★★☆☆

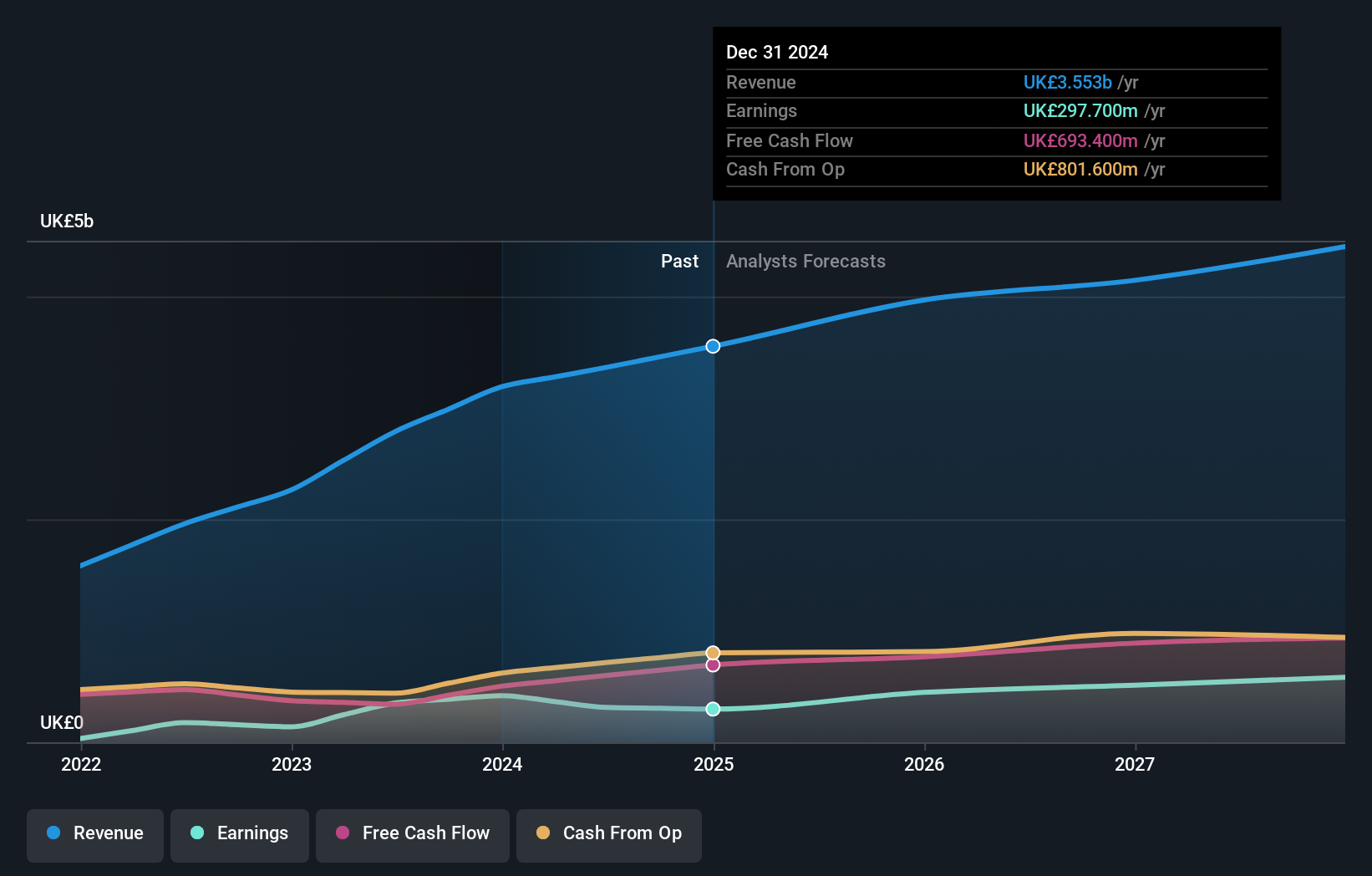

Overview: The Sage Group plc is a technology company that offers solutions and services for small and medium-sized businesses globally, with a market capitalization of approximately £10.07 billion.

Operations: Sage Group generates revenue primarily from its operations in North America (£1.01 billion), Europe (£595 million), and the United Kingdom & Ireland (£488 million). The company focuses on providing technology solutions and services to small and medium-sized businesses across these regions.

Sage Group, a prominent UK tech firm, is making substantial strides in high-growth sectors with a focus on enhancing its software solutions. The company’s recent partnership with VoPay to integrate advanced payment technologies into Sage Business Cloud underscores its commitment to streamlining financial operations for SMBs. This collaboration not only addresses efficiency challenges by reducing manual processes but also secures and simplifies payroll transactions, highlighting Sage’s proactive approach in adopting innovative solutions that cater to evolving business needs. Moreover, the company has maintained steady revenue growth with a 9% increase this quarter and is comfortable projecting similar trends moving forward. This performance is supported by an R&D expenditure that bolsters continuous product development and competitive positioning in the market.

Turning Ideas Into Actions

Seeking Other Investments?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com