Over the last 7 days, the United Kingdom market has remained flat, yet it is up 11% over the past year with earnings forecast to grow by 14% annually. In this context, identifying high growth tech stocks like GB Group involves looking for companies that demonstrate strong potential for expansion and innovation in a stable yet promising market environment.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| YouGov | 14.29% | 29.79% | ★★★★★☆ |

| Facilities by ADF | 52.00% | 144.70% | ★★★★★☆ |

| LungLife AI | 100.61% | 100.97% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Windar Photonics | 63.60% | 126.92% | ★★★★★☆ |

| Oxford Biomedica | 21.00% | 98.44% | ★★★★★☆ |

| Beeks Financial Cloud Group | 22.12% | 36.94% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

Click here to see the full list of 49 stocks from our UK High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GB Group plc, with a market cap of £809.29 million, offers identity data intelligence products and services across the United Kingdom, the United States, Australia, and other international markets.

Operations: GB Group generates revenue through three main segments: Identity (£156.06 million), Location (£81.07 million), and Fraud (£40.20 million). The company’s operations span multiple international markets, focusing on identity data intelligence solutions.

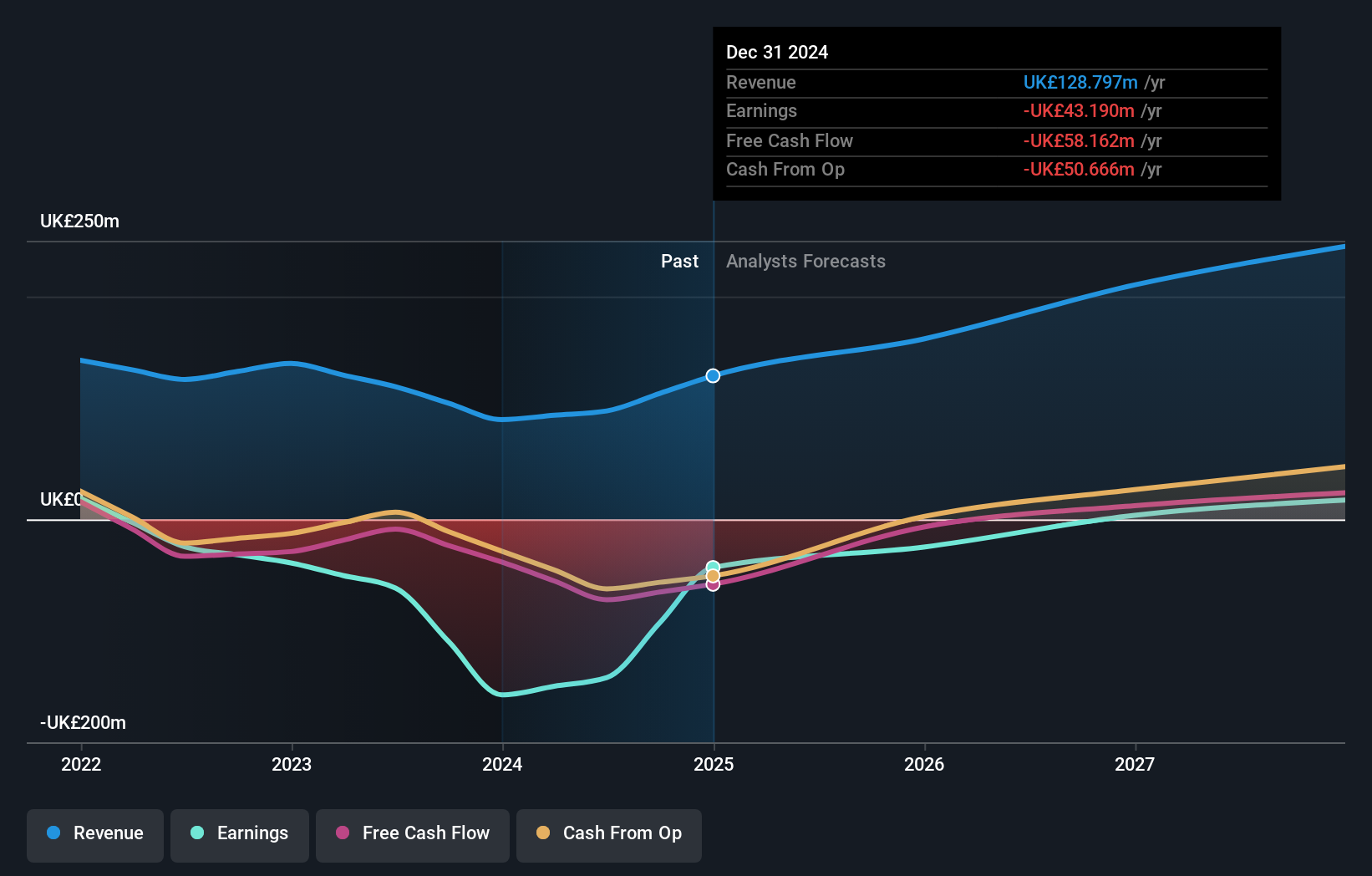

GB Group, amidst a challenging landscape for tech firms in the UK, is navigating with strategic R&D investments and an anticipated profitability turnaround. With R&D expenses marked at 6.1% of revenue, the firm is aligning its innovation efforts closely with industry demands. Despite current unprofitability, GBG’s earnings are expected to surge by 90.6% annually, showcasing potential for significant financial improvement. Moreover, recent announcements including a dividend increase to 4.20 pence highlight management’s confidence in future cash flows and operational stability.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Oxford Biomedica plc is a contract development and manufacturing organization dedicated to providing therapeutic solutions globally, with a market capitalization of approximately £440.40 million.

Operations: Oxford Biomedica focuses on delivering therapeutic solutions globally, primarily generating revenue through its platform segment, which accounts for £97.24 million.

Oxford Biomedica, amid a challenging tech landscape in the UK, is making significant strides with a robust R&D focus and promising revenue forecasts. The company’s R&D expenses are pivotal, aligning closely with its strategic goals to innovate within the biotech sector. Notably, its annual earnings are projected to surge by 98.4%, reflecting strong future potential despite current unprofitability. With recent corporate guidance confirming a revenue CAGR of over 35% between 2023 and 2026 and an expected annual revenue growth of 21%, Oxford Biomedica is setting a brisk pace compared to the broader UK market’s growth rate of just 3.5%. These financial indicators, coupled with strategic executive appointments like Lucinda Crabtree as CFO, underscore the firm’s commitment to bolstering its financial and operational framework moving forward.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: The Sage Group plc, with a market cap of £10.26 billion, offers technology solutions and services for small and medium businesses across the United States, the United Kingdom, France, and other international markets.

Operations: Sage Group generates revenue primarily from its operations in North America (£1.01 billion), Europe (£595 million), and the United Kingdom & Ireland (£488 million). The company’s focus is on providing technology solutions to small and medium businesses across these regions.

Sage Group, navigating the competitive landscape of UK tech, has demonstrated a robust commitment to innovation with R&D expenses reflecting a strategic emphasis on development within its software solutions. The company’s recent financials show a revenue upswing of 9% in Q3 2024 to £585 million, supported by its Sage Business Cloud advancements. Notably, Sage’s partnership with VoPay introduces efficient payment solutions that streamline operations for SMBs—a critical move as industry trends shift towards integrated financial management systems. This collaboration not only enhances product offerings but also positions Sage favorably amidst growing demand for comprehensive business solutions. With earnings forecasted to grow by 15.1% annually and R&D investments aligning closely with evolving market needs, Sage is poised to maintain its trajectory in the dynamic tech sector.

Seize The Opportunity

Ready For A Different Approach?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com