The market has been flat over the last week but is up 6.7% over the past year, with earnings forecast to grow by 15% annually. In such a dynamic environment, identifying high-growth tech stocks like Craneware and two other promising companies can offer significant opportunities for investors seeking robust returns.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| YouGov | 14.29% | 29.79% | ★★★★★☆ |

| Facilities by ADF | 52.00% | 144.70% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Windar Photonics | 67.08% | 130.82% | ★★★★★☆ |

| LungLife AI | 100.61% | 100.97% | ★★★★★☆ |

| IQGeo Group | 11.49% | 63.61% | ★★★★★☆ |

| Beeks Financial Cloud Group | 24.63% | 57.95% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

Click here to see the full list of 47 stocks from our UK High Growth Tech and AI Stocks screener.

Let’s explore several standout options from the results in the screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Craneware plc, with a market cap of £803.93 million, develops, licenses, and supports computer software for the healthcare industry in the United States.

Operations: Craneware plc generates revenue primarily through its healthcare software segment, which reported $189.27 million. The company focuses on developing, licensing, and supporting computer software tailored for the U.S. healthcare industry.

Craneware, a UK-based tech firm, showcases robust growth with a reported 8.2% annual revenue increase and an impressive 25.6% forecast in earnings growth, outpacing the UK market’s average. This financial vigor is complemented by strategic expansions through acquisitions aimed at enhancing data capabilities and broadening the U.S. hospital market reach. Notably, its collaboration with Microsoft leverages Azure’s cloud solutions to innovate healthcare applications, ensuring Craneware remains pivotal in transforming healthcare efficiency and data analytics. These initiatives underscore its commitment to maintaining a competitive edge through continuous innovation and strategic market positioning.

Simply Wall St Growth Rating: ★★★★☆☆

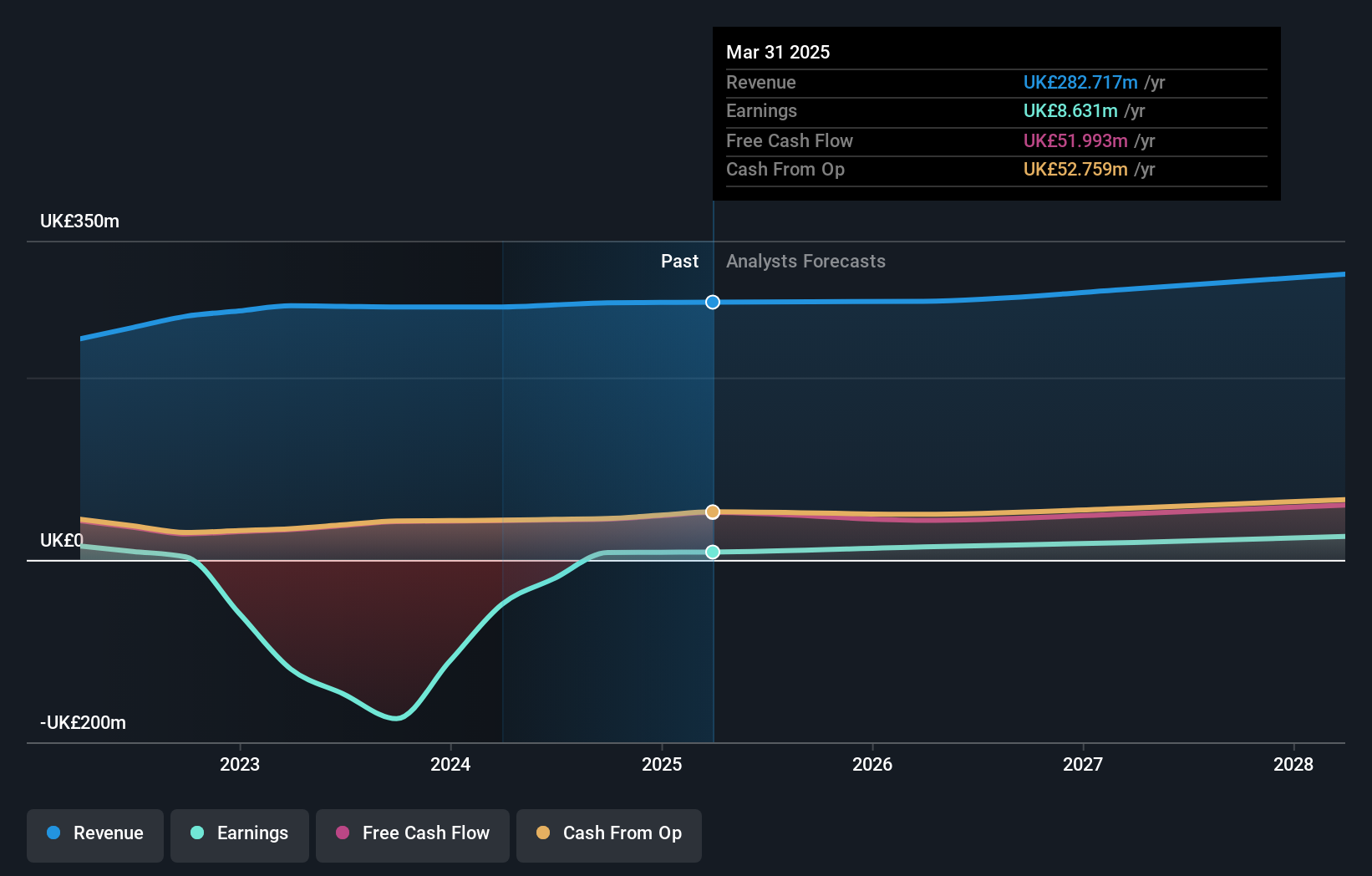

Overview: GB Group plc, with a market cap of £799.20 million, offers identity data intelligence products and services across the United Kingdom, the United States, Australia, and internationally.

Operations: The company generates revenue through three primary segments: Fraud (£40.20 million), Identity (£156.06 million), and Location (£81.07 million). The Identity segment is the largest contributor to its revenue stream.

GB Group, navigating through the competitive tech landscape in the UK, is on a trajectory to profitability with an expected earnings growth of 92.9% annually. This growth is particularly notable given the company’s revenue is projected to increase by 6.8% per year, surpassing the UK market average of 3.8%. Despite not being profitable currently, GB Group has maintained positive free cash flow and recently declared a final dividend of 4.20 pence at its AGM, signaling confidence in its financial health and future prospects. These factors combined with strategic initiatives could position GB Group favorably in a rapidly evolving sector.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Capita plc provides consulting, digital, and software products and services to clients in the private and public sectors in the United Kingdom and internationally, with a market cap of £330.25 million.

Operations: Capita generates revenue primarily from two segments: Capita Experience (£1.12 billion) and Capita Public Service (£1.49 billion). The company operates in both the private and public sectors, offering a range of consulting, digital, and software services.

Capita, amid a challenging tech landscape in the UK, has shown resilience with its half-year sales reaching £1.24 billion, a notable recovery from the previous year’s £1.48 billion. The firm successfully transitioned to profitability with a net income of £53 million, reversing last year’s loss of £84.4 million, demonstrating effective cost management and operational efficiency. With R&D expenses constituting 1.5% of revenue, Capita is investing strategically in technology to enhance its service offerings like the Hartlink solution for RMSPS, integrating advanced digital capabilities that promise scalability and improved client service delivery. This pivot not only stabilizes Capita but also aligns it with evolving market demands for more integrated and efficient tech solutions.

Key Takeaways

Ready To Venture Into Other Investment Styles?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com