Aldi

AldiThe boss of Aldi UK says shoppers are treating themselves to more expensive products as cost of living pressures start to ease.

Customers are said to be “trading up” to premium own-label products including Wagyu steak, premium cheese, ready meals, and brioche buns.

It is a shift in behaviour from 2021, when soaring food prices saw a boom in cheaper supermarket own-label products as shoppers cut back and bought fewer brands to save money.

On Monday, Aldi revealed a 16% increase in sales in 2023 and bumper profits, though the discounter has recently lost ground as its competitors fight back.

The supermarket announced it would open 23 new stores in the next 16 weeks as part of an £800m investment plan.

Aldi’s premium own-label ranges is growing ahead of other products, which is a similar picture for the wider grocery market as well.

Premium own-label volumes were up by nearly 16% year-on-year, according to the latest monthly data from the retail research firm Kantar. That compares with a drop of 10% for “value” own-label items.

Some of that increase may be down to consumers, many of who are still feeling pressure on budgets, choosing to eat in at home instead of dining out, as well as opting less often for bigger brands.

“It’s still tough out there for millions of families but inflationary pressures are easing for some,” said Aldi UK chief executive Giles Hurley.

“For others, it’ll be a decision not to use hospitality but to celebrate at home instead.”

With celebrating at home in mind, Aldi’s specially selected range will make up more than 50% of its overall Christmas offering for the first time.

Aldi

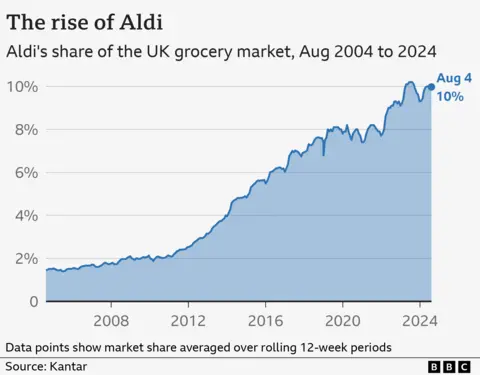

AldiDiscounters Aldi and Lidl have thrived as shoppers have adapted to the higher cost of living.

Aldi’s success is clear from its latest figures, which showed its pre-tax profits more than tripled to a record £536.7m in the year to the end of December 2023, driven by an extra £2.4bn in sales.

Price rises and new store openings drove much of the rise in earnings, but the business also pulled in new customers.

However, the supermarket chain is now growing at a slower rate than most of its big rivals, including Lidl.

This time last year, Aldi was the fastest-growing supermarket, according to industry data, but it has since lost ground in market share as competitors have fought back.

That has led some to wonder if Aldi has lost its mojo, having disrupted the grocery aisles for so long.

Sainsbury’s and Tesco have adopted “Aldi price match” campaigns and all supermarkets apart from Aldi now offer some form of loyalty card schemes.

“There’s always an ebb and flow,” Mr Hurley said, when asked if Aldi had lost customers.

Aldi’s main rival Lidl started its rewards app four years ago, linking it with offers for its in-store bakeries, but Mr Hurley said he was not planning on deploying a similar tactic at Aldi anytime soon.

“I would view loyalty as keeping your commitments around your promises and we offer simple, straightforward pricing and our customers know that,” he said.

He said the supermarket’s story was “about growth, whether that’s over the last 30 years, the last four years, or the last two years”.

“That growth is set to continue and I’m very confident about that because we have massive expansion plans here in the UK,” Mr Hurley added.

But Mr Hurley warned the planning process needs to speed up, with one of his top team holding talks with the new Labour government about reforms to the planning system.

The budget chain has a long-term target of 1,500 UK shops and another 100 stores are being refurbished.

But for Ged Futter, who runs a grocery retail consultancy, the question for Aldi is how it will look to grow further once it stops opening new stores.

“If they’re just talking about price, I don’t think that’s a message that cuts through enough now,” he said.

“The price gap isn’t as strong as it used to be. They’ve got to differentiate themselves a bit more.”