Getty Images

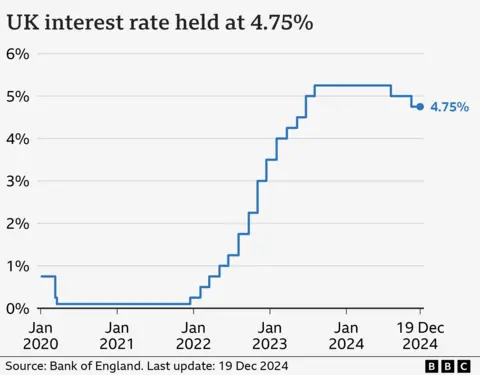

Getty ImagesUK interest rates have been held at 4.75% after the Bank of England voted to keep borrowing costs unchanged.

In an unexpected split, three members of the nine-member rate-setting committee wanted to cut rates to 4.5% to boost growth.

The Bank said it thought the economy had performed worse than expected, with no growth at all between October and December.

Rates are still expected to fall gradually next year, with the first cut possibly coming in February.

Commenting on the decision, Bank governor Andrew Bailey said: “We think a gradual approach to future interest rate cuts remains right but with the heightened uncertainty in the economy we can’t commit to when or by how much we will cut rates in the coming year.”

Speaking later to reporters, Mr Bailey said he thought the path for interest rates was “downwards”, but added: “The world is too uncertain.”

“We will come back in February at our next meeting and review it [interest rates] again.”

Figures this week showed that both inflation was higher than the Bank’s target and wages were growing faster than expected.

But the economy is struggling. Last month, the Bank forecast growth of 0.3% in the final three months of the year, but it now expects 0%.

The revisions will be a blow to Labour which has made boosting economic growth its top priority.

It has promised to deliver the highest sustained economic growth in the G7 group of rich nations.

In the minutes from the meeting, the Bank said there was uncertainty “around how the measures that had been announced in the autumn Budget were affecting growth”.

In the Budget, Chancellor Rachel Reeves announced £40bn worth of tax rises, the majority of which will come from an increase in National Insurance contributions from employers.

By the time of the Bank’s next decision in February, it will have more data on the impact of the Budget changes, as well as Donald Trump’s incoming US trade tariff policies.

Following the Bank’s decision, Chancellor Rachel Reeves said: “We want to put more money in the pockets of working people, but that is only possible if inflation is stable and I fully back the Bank of England to achieve that.”

Liberal Democrat Treasury spokesperson Daisy Cooper MP said: “The new government needs to work much harder if it’s going to turn the economy around any time soon.

“That must start by scrapping the self-defeating jobs tax which promises to make the crisis in health and care even worse.”

Ruth Gregory, deputy chief UK economist at Capital Economics, said the Bank’s policymakers had appeared “to have been more open to cutting interest rates this month than we had expected”.

She said the comments suggested “that the Bank will cut rates quicker than investors expect”.

‘House prices are incredibly high’

Danny McGuire, who lives with his parents in Warrington, Cheshire, would like to get on the property ladder, but the deposit size and the lack of properties within his budget range has made it difficult for him.

“The idea of owning your own home is preferable to renting for myself,” said the 33-year-old, who works for a local council, but added “average house prices are incredibly high”.

Sarah Coles, head of personal finance at Hargreaves Lansdown, said for people looking to secure a fixed-rate mortgage deal, “the fact the market is pricing in fewer cuts between now and the end of 2025 means we’re likely to see mortgage rates rise slightly from here”.

“Mortgage rates have fluctuated over the past month, as the market struggled to make its mind up about the path of future rate cuts. With so much uncertainty around, it can be a good idea for anyone with a looming remortgage to secure a rate now,” she added.