Getty Images

Getty ImagesAverage annual rent on a newly-let property is £3,240 more expensive than at the end of the coronavirus pandemic, according to figures from Zoopla.

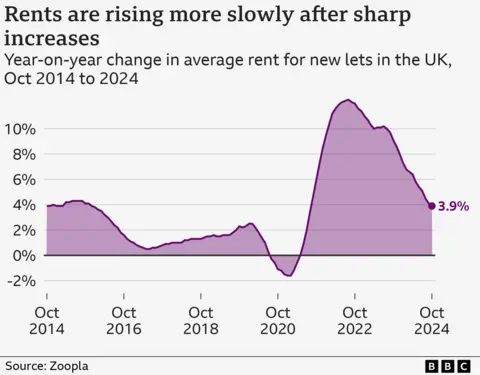

Rent began to soar in 2021 due to high demand from tenants after lockdowns were lifted and limited numbers of available properties.

The annual cost of renting has gone up by 27% in those three years, compared to a 19% rise in average earnings over the same period.

However, the rate at which rents are rising is now the slowest for three years, the property portal has said, as potential tenants face limits on what they can afford.

Signs of cooling market

Renters have faced a “red-hot” market in recent years, with a host of prospective tenants chasing each available property, and rents surging on the back of the high demand. Demand is nearly a third higher than before the pandemic.

It led some applicants to offer months of rent upfront, or to write CV-style letters to agents to try to get ahead of the competition.

Zoopla said there were signs of this market cooling.

But those with the least to spend, in the cheapest areas, may now be facing the sharpest rent rises.

“With more renters than there are homes to rent, people are seeking out the best value for money,” said Richard Donnell, executive director of research at Zoopla.

“Within cities, rents are typically rising faster at the lower end of the market.”

George Carden/BBC

George Carden/BBCThat could hit those on low-incomes, as well as students.

Blyth Eling, a student at the University of Brighton who has a part-time job alongside her studies, spends over £1,000 per month on rent for a room in a flat.

She recently told the BBC that accommodation took up “pretty much all of my student loan”.

“It leaves me with virtually no spending money,” she said.

On average, rents for newly-let properties were now 3.9% higher than a year ago, Zoopla said.

However, pockets of fast-rising rents remained. Annual rental inflation stood at 10.5% in Northern Ireland, compared with 1.3% in London.

In towns and cities, average rents are rising fastest in Rochdale (up 11.9% in a year) and Blackburn (up 10%), and Birkenhead (up 9%). Zoopla said renters were seeking areas in and around major cities.

Landlords’ concerns

Zoopla tracks rents when homes become vacant and are re-let at an open-market rent, accounting for about a quarter of the rental sector.

The property portal has forecast rents rising at an average rate of 4% next year, with demand still outstripping supply.

The increase would come, in part, as a result of fewer properties being made available by landlords.

The National Residential Landlords Association (NRLA) said that 31% of landlords were planning to sell properties they rent out in the next two years.

It wants changes to housing taxation and reassurances over no-fault eviction rules.

“What tenants need is greater choice. That means encouraging and supporting the vast majority of responsible landlords to stay and continue to provide decent quality housing,” said Ben Beadle, chief executive of the NRLA.

Agents say there are some simple ways to make it easier to secure a rental property, including:

- Start searching well before a tenancy ends and sign up with multiple agents

- Have payslips, a job reference, and a reference from a previous landlord to hand

- Build up a relationship with agents in the area, but be prepared to widen your search

- Be sure of your budget and calculate how much you can offer upfront

- Be aware that some agents offer sneak peeks of properties on social media before listing them

There are more tips here and help on your renting rights here.