Getty Images

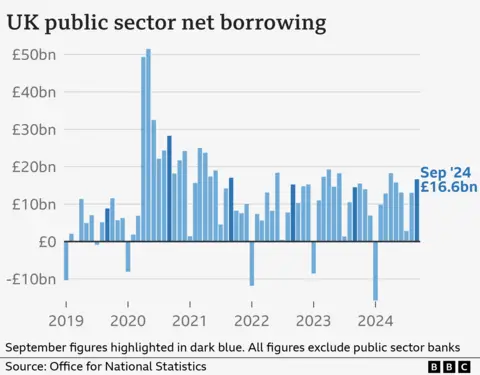

Getty ImagesGovernment borrowing rose last month, marking the third-highest September since records began in January 1993.

Official figures show that borrowing – the difference between spending and tax take – reached £16.6bn, continuing a trend of overshooting official forecasts.

The numbers present a challenge for the Treasury at the Budget next week as it has decided it will not borrow to fund day-to-day spending.

It is, however, expected to change its self-imposed debt rules to give it more leeway on investment, meaning it could spend more on longer-term projects.

Chief Treasury Secretary Darren Jones claimed the new Labour government had inherited a fiscal “black hole” and that resolving this “will require difficult decisions”.

Economists have predicted Labour may raise taxes or cut spending in the Budget on 30 October as it tries to deal with long-running government debts and borrowing.

Some believe it will change its fiscal rules, with Jones giving his clearest indication yet last week that Labour will do so to allow it borrow to invest in big infrastructure projects.

“Today’s data highlights the scale of the public finances challenges facing the chancellor,” said Cara Pacitti, senior economist at the Resolution Foundation.

The Office for National Statistics (ONS) said the spending increase was partly due to higher debt interest and public sector pay rises, such as the one Labour gave to junior doctors to settle their strike action in July.

Meanwhile, the social benefits bill fell by £2bn to £25.7bn, with Labour’s cut to winter fuel payments for wealthier pensioners outweighing the yearly increase in inflation-linked benefits.

‘Limited scope’

“While it is too late for September’s disappointing public finances figures to influence the amount of headroom the Office for Budget Responsibility (OBR) will hand the chancellor in the Budget on 30 October, they do highlight the limited scope the Chancellor has to increase day-to-day spending without raising taxes,” said Alex Kerr, UK economist at Capital Economics.

“That said, if she tweaks her fiscal rules, she will still have room to raise public investment.”

The increased borrowing means the UK’s national debt stood at 98.5% of its economic output at the end of September, a slight drop from the month before but still around levels last seen in the early 1960s.

The OBR, which monitors the UK government’s spending plans and performance, predicted borrowing of £15.1bn for September, less than the actual figure that came in.

It marks a continuation of a trend where official figures have been overshooting OBR forecasts every month since June.

The ONS figure for borrowing the first six months of the financial year is £79.6bn, compared with £73.0bn forecast by the OBR.

The monthly figure for September was, however, lower than expected by economists, who had collectively predicted borrowing of £17.5bn.