Over the last 7 days, the United Kingdom market has risen by 1.1%, and over the past year, it has climbed 12% with earnings forecasted to grow by 14% annually. In this context of positive market momentum, identifying high growth tech stocks such as GB Group can be crucial for investors seeking to capitalize on technological advancements and robust financial performance.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| YouGov | 14.29% | 29.79% | ★★★★★☆ |

| Altitude Group | 23.46% | 27.56% | ★★★★★☆ |

| Facilities by ADF | 52.00% | 144.70% | ★★★★★☆ |

| LungLife AI | 100.61% | 100.97% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Windar Photonics | 63.60% | 126.92% | ★★★★★☆ |

| Oxford Biomedica | 21.00% | 98.44% | ★★★★★☆ |

| Beeks Financial Cloud Group | 22.12% | 36.94% | ★★★★★☆ |

Click here to see the full list of 46 stocks from our UK High Growth Tech and AI Stocks screener.

Here’s a peek at a few of the choices from the screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GB Group plc, along with its subsidiaries, offers identity data intelligence products and services across the UK, US, Australia and globally, with a market capitalization of £819.37 million.

Operations: The company generates revenue through three primary segments: Identity (£156.06 million), Location (£81.07 million), and Fraud (£40.20 million).

GB Group, navigating through a competitive tech landscape, is poised for significant transformations with expected revenue growth of 6.1% annually, outpacing the UK market’s average of 3.5%. This growth is underpinned by strategic R&D investments, which are crucial as the company transitions towards profitability with earnings forecasted to surge by 90.56% per year. Additionally, recent developments such as a dividend increase to 4.20 pence signal confidence in future financial health and shareholder value enhancement. While currently unprofitable, GB Group’s focus on innovation and market expansion initiatives positions it well for upcoming fiscal periods, especially considering its positive free cash flow status that supports ongoing and future operational needs.

Simply Wall St Growth Rating: ★★★★☆☆

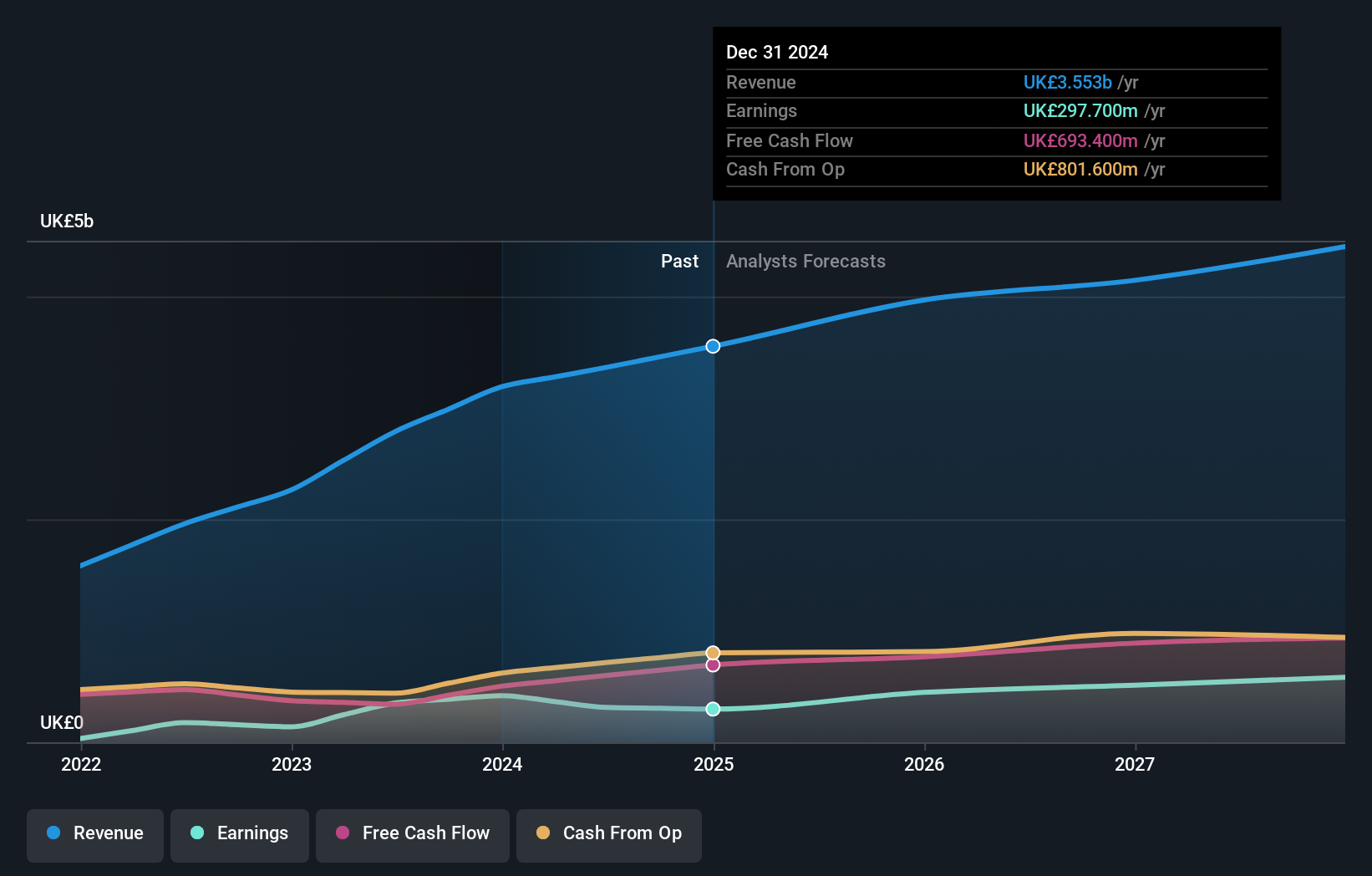

Overview: Informa plc is an international company specializing in events, digital services, and academic research across the United Kingdom, Continental Europe, the United States, China, and other global markets with a market cap of £11.08 billion.

Operations: Informa generates revenue through its four key segments: Informa Tech (£426.70 million), Informa Connect (£630.20 million), Informa Markets (£1.67 billion), and Taylor & Francis (£636.70 million). The company operates across diverse regions, including the UK, Europe, the US, and China, focusing on events, digital services, and academic research.

Informa, with a 7.6% annual revenue growth rate, outperforms the UK’s average of 3.5%, signaling robust sector dynamics despite its recent earnings dip of -11.3% over the past year compared to the Media industry’s 32% rise. The company is set on a high-growth trajectory with earnings expected to climb by 22.5% annually, bolstered by significant R&D investments that underscore its commitment to innovation amidst evolving market demands. Recent strategic moves include expanding its partnership with Monaco and acquiring Ascential plc, enhancing its B2B event capabilities in luxury markets—an area poised for further growth given Informa’s strengthened international presence and diversified service offerings across technology and lifestyle sectors.

Simply Wall St Growth Rating: ★★★★☆☆

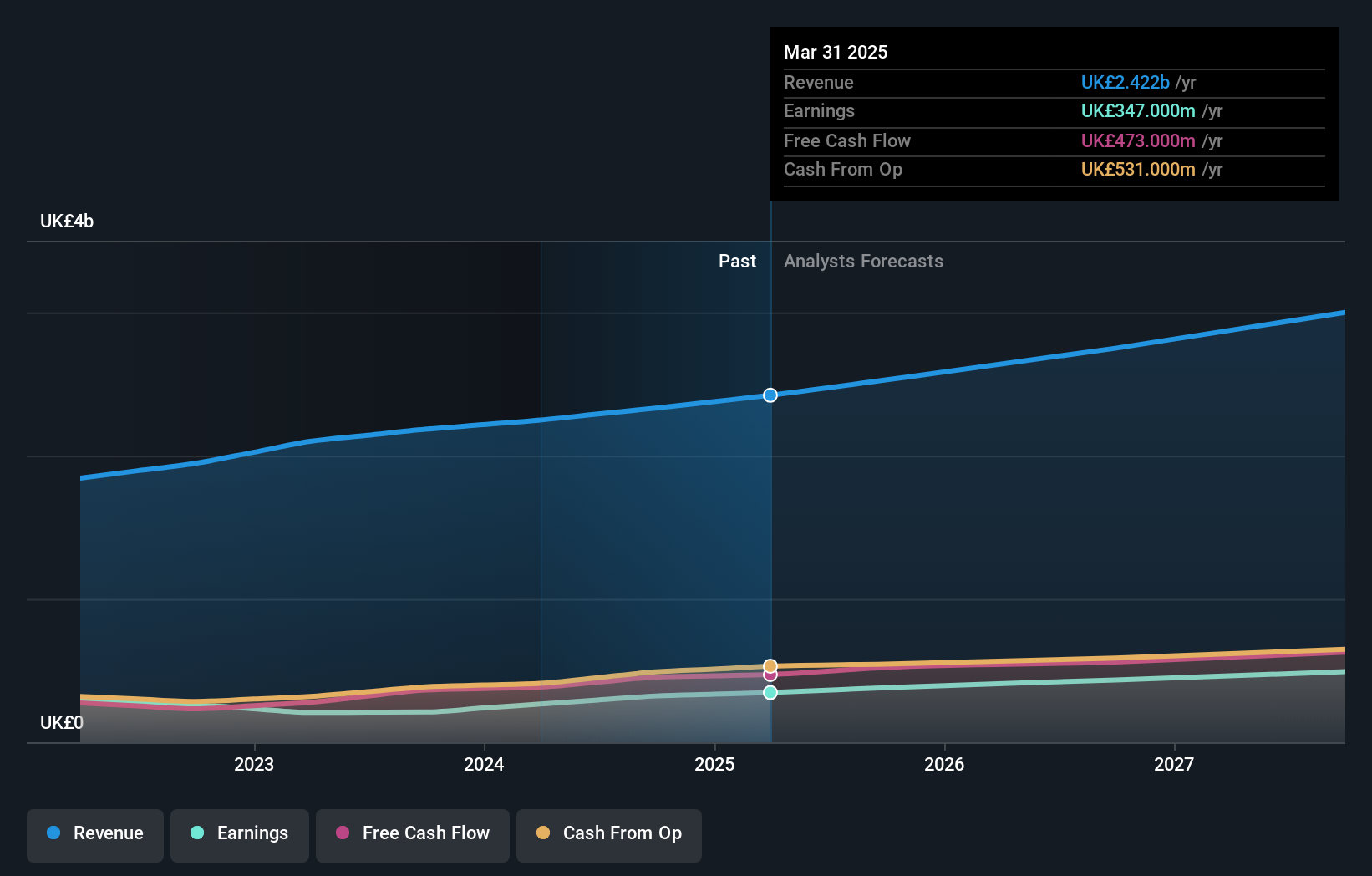

Overview: The Sage Group plc, along with its subsidiaries, offers technology solutions and services tailored for small and medium businesses across the United States, the United Kingdom, France, and other international markets with a market capitalization of approximately £10.37 billion.

Operations: Sage Group generates revenue primarily from its operations in North America (£1.01 billion), Europe (£595 million), and the United Kingdom & Ireland (£488 million). The company focuses on providing technology solutions and services for small and medium businesses across these regions.

Sage Group, a key player in the UK’s tech landscape, is navigating through dynamic market conditions with a notable 7.7% annual revenue growth, outpacing the broader UK market average of 3.5%. This growth is supported by substantial R&D investments that have not only fueled a 28.4% surge in earnings over the past year but are also projected to drive future earnings at an impressive rate of 15.1% annually. Recent strategic developments include a partnership with VoPay, integrating advanced payment technologies into Sage’s platforms which directly address efficiency challenges faced by SMBs, enhancing payroll functionalities and financial operations significantly. This move underscores Sage’s commitment to innovation and its ability to adapt to evolving business needs, positioning it well for sustained growth amidst competitive pressures.

Turning Ideas Into Actions

Curious About Other Options?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com